1Pavanatma College, Murickassery, Kerala, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Microfinance is at the forefront of economic empowerment and poverty alleviation in underprivileged communities. It is an entirely accepted channel for promoting women’s empowerment and eventually realising economic freedom and development. This study highlights the unique role played by microfinance in empowering women in rural areas, a unique state that ranks high in most of the progressive social and demographic indicators. The study’s findings indicated the importance of microfinance in women’s empowerment. The findings revealed that microfinance plays a unique role in women’s empowerment and that all the respondents expressed satisfaction with most aspects of microfinance, such as interest rate, customer service, modes of repayment, financial education and training and procedures involved in approving loans. The study is significant for policymakers and others similarly tasked with developing initiatives to enhance women’s empowerment.

Microfinance, policymakers, social indicators, women’s empowerment

Introduction

Microfinance is often lauded as a catalyst for poverty alleviation and socioeconomic development, and for creating transformative opportunities for marginalised sectors worldwide; it is said to be the engine of poverty alleviation and socioeconomic development. Women are at the centre of the significant changes in microfinance services. While microfinance has proven effective in enhancing women’s empowerment socially and economically, its influence on political empowerment remains a topic of debate. Research conducted by Pervin et al. (2023) found that microfinance primarily fosters social empowerment among women, with limited impact on their economic or political empowerment, particularly in decision-making processes. Additionally, Zafarullah and Nawaz (2019) have suggested that while microfinance positively affects women’s empowerment, other interventions may play more critical roles in empowering women.

Women’s empowerment has increased by improving greater economic sustainability among women in both the urban and rural landscapes through access to microfinance (Sunitha et al., 2020). By providing access to credit and savings accounts, microfinance programmes allow women to establish and expand businesses, while investing in activities that generate income and build assets. Through microfinance, women can escape poverty and reliance and eventually become self-sufficient, establishing financial freedom that improves their and their family’s well-being. Women participating in microfinance programmes experience better economic conditions because they develop self-reliant income sources, asset acquisition and increased savings levels, thereby building economic independence (Mengstie, 2022). Similarly, Lyngdoh and Pati (2013) discovered that microfinance positively impacts women’s empowerment, improving income, expenditure management, savings, asset ownership, access to livestock and micromachines, family wealth and political participation.

Statement of the Problem

In numerous cultures, women often encounter built-in obstacles that make it difficult to use standard financial services like banks and typical loan providers. These challenges, including bias based on gender, a shortage of assets for security, and not enough knowledge about finances, often force women to the edges of the economy. In many situations, women face challenges. Microfinance, which offers low-income people small loans and other forms of financial support, is a powerful tool for removing these barriers and providing women access to new economic opportunities. When women gain financial freedom and social standing thanks to microfinance programmes, they are more prepared to join community efforts, participate in local groups, and have a say in policies that impact their lives. By giving women a stronger voice and supporting them as leaders, microfinance helps create fairer, more inclusive communities. This research explores the different aspects of microfinance and its potential to empower women in rural areas.

Objectives of the Study

Research Methodology

This section outlines the research methods employed in the study, justifying their suitability for addressing the research objectives. The study adopted a mixed-methods approach, combining primary and secondary data, sampling and data analysis to ensure a comprehensive literature review and data analysis.

Review of Literature

Several studies affirm that microfinance positively influences women’s economic empowerment. Microfinance services empower women by enhancing their income, savings and socioeconomic status, allowing them to contribute positively to their families and society (Dash et al., 2016). Hameed et al. (2018) found that microfinance services can help reduce poverty for rural women and boost their economic and social standing. Likewise, Mengstie (2022) noted that microfinance supports women in becoming economically independent by raising their incomes, helping them buy things and promoting regular savings.

Baruah et al. (2022) found that women experienced a noticeable boost in their economic, psychological, personal and social empowerment after using microfinance services, with economic empowerment being the most highlighted benefit. Mengstie and Singh (2020) expressed that microfinance promotes women’s economic empowerment by boosting their independent income, expanding asset ownership and fostering savings. The study highlights the significant impact of factors such as credit amount, age, training, education level and marital status on women’s economic development through microfinance. It points out how crucial microfinance institutions are for helping women entrepreneurs grow their businesses. Temba et al. (2023) also reported that microfinance programmes helped women participate in income-generating activities and work towards reducing gender inequality in rural areas.

Microfinance does more than help with money; it also supports social empowerment. Anwar and Aslam (2017) pointed out that women involved in microfinance felt more confident and had a more prominent voice in their homes and communities. Similarly, Sanyal (2009) mentioned that microfinance helps women make connections and strengthen their influence, which helps them feel empowered overall. This shows that microfinance is vital for encouraging women to work together and support each other in their communities. Likewise, Maîtrot (2021) mentioned that microfinance gives women the tools to take on societal expectations and make choices that can lift them out of poverty. Datta and Singh (2019) pointed out that microfinance helped women boost their incomes and encouraged them to take on leadership roles in community groups. Sahoo and Rath (2016) found that microfinance helped rural women access credit and made them more independent in handling household finances.

Sultana and Hasan (2021) studied the Grameen Bank model and noted that microfinance made rural women more confident, financially independent, and able to speak up in family discussions. Rahman et al. (2017) showed that microfinance positively impacts many aspects of women’s empowerment. The results indicate that microfinance significantly contributes to enhancing women’s empowerment, consistent with the task’s emphasis on the role of microfinance in promoting women’s empowerment. Mekonnen and Tessema (2022) found that women with ongoing access to microfinance show better decision-making skills and more control over household resources.

Banerjee et al. (2015) found that microcredit programmes had a negligible impact on income but boosted women’s engagement in business and self-employment. Karlan et al. (2016) proved that community-based microfinance helped women feel more financially secure and build group support and decision-making skills. According to Mengstie and Singh (2020), microfinance institutions are pivotal in promoting women’s entrepreneurship and business expansion. Chowdhury et al. (2020) argued that, while microfinance can help empower women, how well it works can depend on local factors like gender norms and institutional practices. Mayoux (2001) pointed out that microfinance programmes that build social ties can help empower women. The article expressed that looking closely at the norms and networks pushed in these programmes, especially when helping the most marginalised women, is essential. Neglecting power dynamics and inequalities in favour of reducing programme costs through social capital may hinder the goals of empowerment, financial sustainability and poverty alleviation.

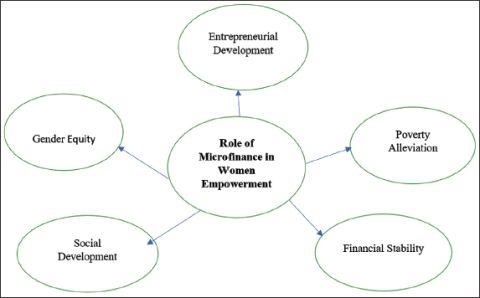

Ranganathan et al. (2021) identified that combining microfinance with additional programmes, known as ‘Microfinance Plus’, has shown promise in empowering women and addressing intimate partner violence. It shows that, while microfinance is helpful for women, it works even better when combined with other support programmes. They suggest that a better strategy for helping women might involve more than microfinance. Lee and Huruta (2022) described the importance of financial literacy as a mediator in the correlation between women’s empowerment and green microfinance. They construct a model wherein green microfinance is the outcome, financial literacy acts as a mediator, and women’s empowerment is the exposure variable. Understanding money matters is key to connecting women’s empowerment and green microfinance. This shows how important it is to have local financial education programmes for women to support eco-friendly practices in microfinance. Duflo (2012) looked at the significant relationship between economic growth and women’s empowerment, which also put forth how development programmes play a role in closing the gender gap and that empowering women, in turn, puts forth progress in general. Examining how microfinance affects women’s empowerment requires understanding this crucial link between empowering women and advancing economic development The conceptual model of the role of microfinance in women’s empowerment is depicted in Figure 1.

Figure 1. Conceptual Model of Role of Microfinance in Women’s Empowerment.

Data Analysis and Interpretation

Demographic Profile of Respondents

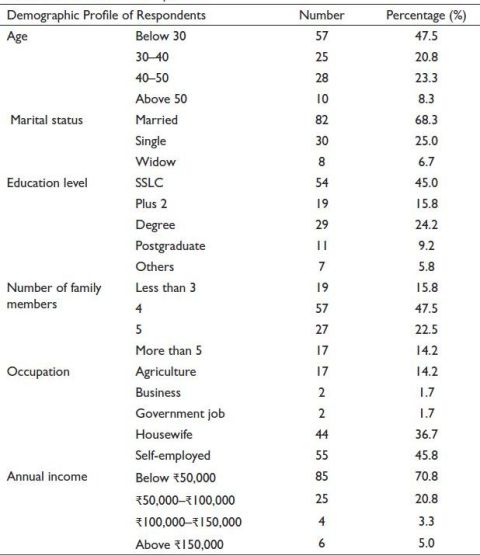

Table 1 shows the classification of responses.

Table 1 shows that the demographic profile of the respondents is delineated across various categories, including age, marital status, education level, number of family members, occupation and annual income. In terms of age distribution, the largest proportion of respondents falls below the age of 30, constituting 47.5%, followed by 30–40 years (20.8%), 40–50 years (23.3%) and those above 50 years (8.3%). Regarding marital status, the majority of respondents are married, comprising 68.3%, while single individuals account for 25.0%, and widows make up 6.7% of the total respondents. In terms of education level, respondents with SSLC education constitute the highest proportion at 45.0%, followed by those with a degree (24.2%), plus 2 (15.8%), postgraduate (9.2%) and others (5.8%). The number of family members varies, with 47.5% having four members, 22.5% having five members, 15.8% having less than three members and 14.2% having more than five members. In terms of occupation, self-employed individuals represent the largest group at 45.8%, followed by housewives (36.7%), agriculture workers (14.2%) and individuals engaged in business and government jobs, each constituting 1.7%. Lastly, in terms of annual income, the majority of respondents have an income below ₹50,000 (70.8%), followed by ₹50,000–₹100,000 (20.8%), ₹100,000–₹150,000 (3.3%) and above ₹150,000 (5.0%).

Table 1. Classification of Responses.

Source: Survey data.

Role of Microfinance in Women’s Empowerment

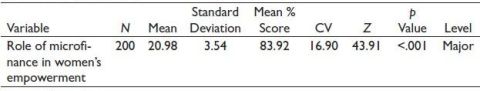

To assess the role of microfinance in women’s empowerment, respondents are asked questions under various headings such as ‘gender equality support’, ‘income generation support’, ‘social empowerment support’, ‘entrepreneurial support’ and ‘poverty alleviation support’ on a five-point Likert scale. The responses are scored as follows: 1 for ‘no role’, 2 for ‘minor role’, 3 for ‘neutral’, 4 for ‘moderate role’ and 5 for ‘major role’. The total score of the five questions for all 120 respondents is calculated, based on which the mean percentage score role of microfinance institutions is determined .png) . This score is classified into one of the four groups: ‘no role’ if the mean percentage score is less than 35%, ‘minor role’ if the mean percentage score is between 35% and 50%, ‘moderate’ if the mean percentage score lies in the interval of 50%–75%, and ‘major’ if the mean percentage score is above 75%.

. This score is classified into one of the four groups: ‘no role’ if the mean percentage score is less than 35%, ‘minor role’ if the mean percentage score is between 35% and 50%, ‘moderate’ if the mean percentage score lies in the interval of 50%–75%, and ‘major’ if the mean percentage score is above 75%.

Table 2. Means, Standard Deviation and Z Value for the Role of Microfinance in Women’s Empowerment.

Source: Survey data.

Overall Role of Microfinance in Women’s Empowerment. The overall role of microfinance institutions in women’s empowerment is depicted in Table 2.

H0:The overall role of microfinance in women’s empowerment is equal to 75% of the total score.

Table 2 reveals that the mean percentage score value of the overall role of microfinance in women’s empowerment is 83.92%, indicating that the role of microfinance in women’s empowerment is at the major level. The coefficient of variation indicates that this score is stable, as the value is less than 20%. Table 2 shows that the p value is less than .05, and the Z value is positive, indicating that the test is significant. Hence, it is concluded that the overall role of microfinance in women’s empowerment is between 75% and 100%, that is, major.

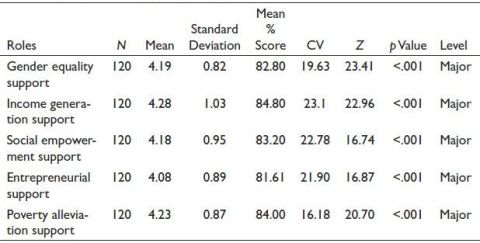

Variables-based Role of Microfinance in Women’s Empowerment. The variable-based role of microfinance in women’s empowerment is represented in Table 3.

H0: The role of microfinance in women’s empowerment variables is equal to 75% of the total score.

Table 3 reveals that the mean percentage score value of all variables lies between 75% and 100%, indicating a major role. Table 3 shows that the p values are less than .05, and the Z value is positive, indicating that the tests are significant. Hence, it is concluded that all variables regarding the role of microfinance in women’s empowerment range between 75% and 100%, that is, major.

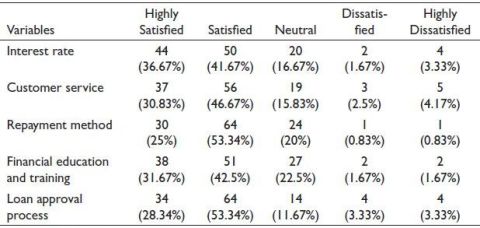

The Level of Satisfaction of Women with Microfinance. Table 4 shows the level of satisfaction of women with microfinance.

Table 4 presents respondents’ satisfaction level regarding various aspects of their experience with microfinance, broken down into categories: interest rates, customer service, repayment method, financial education and training and loan approval process. Each category is divided into five satisfaction levels: highly satisfied, satisfied, neutral, dissatisfied and highly dissatisfied, along with the corresponding number of respondents and their percentages. Regarding interest rates, the majority of respondents expressed either satisfaction or high satisfaction, with 41.67% being satisfied and 36.67% being highly satisfied. Regarding customer service, a significant proportion of respondents reported satisfaction, with 46.67% being satisfied and 30.83% being highly satisfied. For the repayment method, a majority of respondents expressed satisfaction, with 53.34% being satisfied and 25% being highly satisfied. In terms of financial education and training, satisfaction levels were relatively evenly distributed, with 42.5% of respondents being satisfied and 31.67% being highly satisfied. For the loan approval process, satisfaction levels were also high, with 53.34% of respondents being satisfied and 28.34% being highly satisfied. Dissatisfaction levels were relatively low, with only 3.33% of respondents being dissatisfied or highly dissatisfied.

Table 3. Means, Standard Deviation and Z Value for the Variable-wise Role of Microfinance in Women’s Empowerment.

Source: Survey data.

Table 4. Level of Satisfaction of Women with Microfinance.

Source: Survey data.

Findings and Suggestions

Microfinance is essential for promoting women’s empowerment, offering a route to financial autonomy and socioeconomic advancement. Through microfinance programmes, women have gained access to essential resources and support, facilitating gender equality, income generation, social empowerment, entrepreneurship and poverty alleviation. The majority of respondents expressed that microfinance plays a significant role in women’s empowerment and were satisfied with various parameters such as interest rates, customer service, repayment methods, financial education and training, and the loan approval process of microfinance. However, despite these strides, challenges such as limited access to education, cultural obstacles and resource constraints persist, hindering the sustainable success of microfinance initiatives aimed at empowering women. Moreover, coupling financial literacy programmes with microfinance initiatives can empower women by providing them with essential expertise and competencies to proficiently handle their finances, make well-informed choices and embark on entrepreneurial endeavours.

Moreover, microfinance institutions can provide comprehensive support beyond financial assistance by offering entrepreneurship training, mentorship programmes and access to markets. These additional resources empower women to establish and grow their businesses, contributing to their economic independence and overall empowerment. By addressing cultural and social barriers, promoting gender equality within institutions and fostering supportive networks among women beneficiaries, microfinance can act as a catalyst for transformative change. Empowered women are better positioned to assert control over their lives, realise their full potential and actively contribute to sustainable community development.

Conclusion

Microfinance has become a strategic tool in promoting women’s economic and social status, especially among marginalised communities. Simplifying access to credit and other financial products allows women to pursue income-generating activities and improve the financial security of their households. The reported positive impacts by most women, such as satisfaction with loan processes, customer services and financial education, highlight the contribution of microfinance towards financial independence. Things like cultural expectations, a lack of education and institutional biases hold back the full benefits of microfinance programmes. To truly help, we must tailor our efforts to the issues women face in various areas. Adding financial education to microfinance programmes has proven helpful in teaching women how to manage their money better and think like entrepreneurs.

Making it easier to get credit and other financial services is key in microfinance. Support systems like business training, mentorship and market access help. They give women the confidence and skills they need to stand independently. It is also crucial to change policies so that financial systems support and cater to women's needs in microfinance. Building support networks among peers is important because they help women grow stronger by learning from each other and working as a team. These networks can be places for sharing ideas, helping each other, and standing up for what is right. We also need to tackle the social and institutional issues that hold women back from fully joining in on economic activities. Empowerment should be understood as a multidimensional concept involving financial independence, social recognition and personal agency. Women who experience such transformation are better positioned to lead change within their families and communities. As microfinance evolves, its success will depend on integrating financial services with education, support systems and inclusive policies. Ultimately, women who are empowered through these multifaceted approaches contribute meaningfully to inclusive growth and long-term sustainable development.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Shaji Thomas  https://orcid.org/0000-0001-8707-4376

https://orcid.org/0000-0001-8707-4376

Anwar, M., & Aslam, M. (2017). Microfinance institutions and women empowerment: Empirical evidence from Pakistan. Pakistan Journal of Social Sciences, 37(2), 317–3

Banerjee, A., Karlan, D., & Zinman, J. (2015). Six randomized evaluations of microcredit: Introduction and further steps. American Economic Journal: Applied Economics, 7(1), 1–21.

Baruah, I., Bora, M., & Deka, M. J. (2022). Impact of Bandhan microfinance on empowerment of rural women in Tinsukia district of Assam. Asian Journal of Agricultural Extension, Economics & Sociology, 77–84. https://doi.org/10.9734/ajaees/2022/v40i330862

Chowdhury, M., Sarker, S. C., & Alam, F. (2020). Microfinance and women’s empowerment in rural Bangladesh: A multidimensional analysis. World Development Perspectives, 17, 100174. https://doi.org/10.1016/j.wdp.2020.100174

Dash, M., Prasad, V., & Koshy, C. (2016). Women empowerment through microfinance services. Journal of Applied Management and Investments, 5, 20–25.

Datta, D., & Singh, S. (2019). Microfinance and women’s empowerment: An empirical study in rural India. International Journal of Social Economics, 46(3), 368–384. https://doi.org/10.1108/IJSE-04-2018-0191

Duflo, E. (2012). Women empowerment and economic development. Journal of Economic Literature, 50(4), 1051–1079. https://doi.org/10.1257/jel.50.4.1051

Hameed, S., Bano, S., & Iqbal, J. (2018). Impact of microfinance on poverty alleviation and women empowerment. Journal of Business and Social Review in Emerging Economies, 4(1), 47–56. https://doi.org/10.26710/jbsee.v4i1.297

Karlan, D., Osman, A., & Zinman, J. (2016). Measuring the impact of community-based microfinance in the Philippines. Journal of Development Economics, 120, 1–16. https://doi.org/10.1016/j.jdeveco.2015.12.002

Lee, C., & Huruta, A. D. (2022). Green microfinance and women’s empowerment: Why does financial literacy matter? Sustainability, 14(5), 3130. https://doi.org/10.3390/su14053130

Lyngdoh, B., & Pati, A. (2013). Impact of microfinance on women empowerment in the matrilineal tribal society of India: An analysis using propensity score matching and difference-in-difference. International Journal of Rural Management, 9, 45–69. https://doi.org/10.1177/0973005213479207

Maîtrot, M. (2021). The moral economy of microfinance in rural Bangladesh: Dharma, gender and social change. Development and Change, 53(2), 335–355. https://doi.org/10.1111/dech.12700

Mayoux, L. (2001). Tackling the down side: Social capital, women’s empowerment and microfinance in Cameroon. Development and Change, 32(3), 435–464. https://doi.org/10.1111/1467-7660.00212

Mekonnen, Y., & Tessema, S. (2022). The impact of microfinance on rural women’s empowerment in Ethiopia: Evidence from panel data. African Journal of Economic and Management Studies, 13(4), 691–707. https://doi.org/10.1108/AJEMS-08-2021-0315

Mengstie, B. (2022). Impact of microfinance on women’s economic empowerment. Journal of Innovation and Entrepreneurship, 11(1). https://doi.org/10.1186/s13731-022-00250-3

Mengstie, B., & Singh, A. (2020). Ethiopian women economic empowerment through microfinance. Indian Journal of Finance and Banking, 4(2), 51–57. https://doi.org/10.46281/ijfb.v4i2.708

Pervin, S., Ismail, M., & Noman, A. (2023). Does microfinance singlehandedly empower women? A case study of Bangladesh. Sage Open, 13(2), 215824402210961. https://doi.org/10.1177/21582440221096114

Rahman, M. M., Khanam, R., & Nghiem, S. (2017). The effects of microfinance on women’s empowerment: New evidence from Bangladesh. International Journal of Social Economics, 44(12), 1745–1757. https://doi.org/10.1108/ijse-02-2016-0070

Ranganathan, N., Stern, E., Knight, L., Muvhango, L., Molebatsi, M., Polzer-Ngwato, T., & Stöckl, H. (2021). Women’s economic status, male authority patterns and intimate partner violence: A qualitative study in rural North West Province, South Africa. Culture, Health & Sexuality, 24(5), 717–734. https://doi.org/10.1080/13691058.2021.1880639

Sahoo, S., & Rath, B. N. (2016). Microfinance and rural development: Evidence from India. International Journal of Social Economics, 43(12), 1412–1427. https://doi.org/10.1108/IJSE-04-2015-0096

Sanyal, P. (2009). From credit to collective action: The role of microfinance in promoting women’s social capital and normative influence. American Sociological Review, 74(4), 529–550. https://doi.org/10.1177/000312240907400402

Sultana, A., & Hasan, T. (2021). Women empowerment through microfinance: A study on Grameen Bank in Bangladesh. South Asian Journal of Business Studies, 11(1), 34–51. https://doi.org/10.1108/SAJBS-07-2020-0211

Sunitha, K., Rathi, R., Sanyal, A., & Daftari, K. (2020). Microfinance and women empowerment in India. International Journal of Management Studies. https://doi.org/10.18843/ijms/v7i1/02

Temba, L., Mwaipopo, L., & Ismail, K. (2023). Assessing the role of microfinance in empowering rural women in Sub-Saharan Africa. Development in Practice, 33(5), 623–639. https://doi.org/10.1080/09614524.2023.2198201

Zafarullah, H., & Nawaz, F. (2019). Pathways to women’s empowerment in Bangladesh. Asian Education and Development Studies, 8(4), 387–404. https://doi.org/10.1108/aeds-11-2018-0168