1 Department of Commerce, Bodoland University, Kokrajhar, Assam, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed

Financial inclusion is essential for the effective channelisation of money, allowing individuals to access financial products and services that enhance their financial well-being and contribute to the economic growth of a nation. Governments worldwide are recognising the importance of financial inclusion and are taking initiatives to enhance it. In India, the Pradhan Mantri Jan Dhan Yojana (PMJDY), launched in 2014 stands as a significant effort by the government to boost financial inclusion. This study is an attempt to assess financial inclusion across Indian states and union territories, focusing on three key dimensions: automated teller machines (ATM) penetration, insurance penetration and mutual fund penetration. This study is based entirely on secondary data, sourced from the annual reports of the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority of India (IRDAI), Securities and Exchange Board of India (SEBI), Association of Mutual Funds in India (AMFI) and Unique Identification Authority of India (UIAI). The findings of this study provide valuable insights into the current state of financial inclusion in India and will contribute to effective policy formation aimed at enhancing financial inclusion across Indian states and union territories.

Financial inclusion, accessibility, ATM deployment, insurance penetration

Introduction

Financial inclusion entails ensuring that individuals and businesses have access to affordable and suitable financial products and services, enabling them to fulfil their financial needs, save securely, invest in their future and manage risks effectively (World Bank, 2022). It is vital for both the financial well-being of individuals and the overall growth of the economy (Dahiya & Kumar, 2020; Ratnawati, 2020; Steffi, 2020; Tiwari et al., 2022). Financial inclusion empowers individuals by providing the necessary tools to manage their finances, access credit and invest in areas such as education and health, which lead to an improved quality of life and economic stability. Additionally, financial inclusion enhances economic participation, reduces poverty and inequality and integrates more transactions into the formal economy, thereby increasing tax revenues and facilitating better economic planning. Conversely, low financial inclusion results in economic disparities, stunted economic growth and increased vulnerability to economic shocks. Although numerous initiatives, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) in India, focus on expanding the supply of financial services, this approach alone is insufficient for achieving comprehensive financial inclusion. True financial inclusion necessitates that individuals actively utilise these services (Gupta & Thakur, 2020). Therefore, demand-side interventions are critical. These include financial literacy programmes, measures to build trust, user-friendly product designs and community outreach efforts to raise awareness and encourage engagement with financial services. By addressing both the supply and demand aspects, financial inclusion initiatives can more effectively integrate individuals into the financial system, thereby enhancing personal financial stability and driving economic growth.

As mentioned above, financial inclusion is contingent upon the interplay of demand-side and supply-side elements, both of which are vital in guaranteeing the extensive availability of financial services. The following is a description of both:

Supply-Side Factors

Supply-side factors encompass elements such as the accessibility, affordability and availability of financial products and services. These consist of:

Demand-Side Factors

Demand-side factors refer to the willingness, ability and preferences of individuals to access and utilise financial services. These include:

To bolster participation in the formal financial system, prioritising the demand side is crucial. By addressing the above-mentioned demand side factors, India can effectively encourage greater engagement with the formal financial system, leading to broader financial inclusion and economic empowerment across its diverse population.

Significance of the Study

In light of the fact that the PMJDY was initiated by the Government of India almost a decade ago, it is critical to evaluate the present condition of financial inclusion in the nation. This achievement highlights the urgency to assess the current condition of financial inclusion, rendering this research pertinent and time-bound. This research endeavours to offer significant insights into the dynamic financial access and utilisation landscape in India by analysing the advancements achieved since the establishment of PMJDY. The findings will contribute to the development of policy orientations and strategies that promote inclusive finance in the future.

Review of Literature

This section presents the rigorous review of literature on financial inclusion, conducted to understand and identify the gap in the existing literature.

Existing studies conducted by Dhhiya and Kumar, 2020; Sil, 2020; Stefi, 2020; and Tiwari et al., 2021; Chafa et al., 2023; Panakaje et al., 2023 establish the relationship between financial inclusion and economic development revealing that financial inclusion plays a pivotal role in promoting sustainable economic development and inclusive growth. By providing individuals and businesses with access to essential financial services such as savings, credit, insurance and payment systems, financial inclusion empowers people to manage risks, invest in education and businesses and improve their livelihoods. This, in turn, stimulates economic activity, reduces poverty and narrows income inequalities. Moreover, financial inclusion fosters economic resilience by enabling a broader base of the population to participate in the formal economy, contributing to more stable and equitable growth. Inclusive financial systems also enhance resource allocation and improve the effectiveness of economic policies, further supporting sustainable development. By ensuring that all segments of society, including the most vulnerable, have access to financial services, financial inclusion helps build a more inclusive and prosperous economy for the long term.

The literature reveals that the definition of financial inclusion has evolved over time. Initially, it focused solely on access to financial products and services. However, the concept now encompasses both access and the active use of these financial products and services (Gupta & Thakur, 2020). Simply having a bank account does not qualify a person as financially included; active engagement, such as making transactions, deposits, withdrawals, obtaining credit or investing in financial assets, is also necessary.

Major initiatives like the PMJDY aim to enhance financial access, as evidenced by the significant increase in bank account openings. However, financial well-being cannot be achieved solely through the act of opening bank accounts (Gupta & Thakur, 2020). Beneficiaries must also be financially literate to understand the importance of financial products and to select those that best suit their needs. Therefore, efforts must be made to enhance the financial literacy of beneficiaries.

The increase in distance to reach the banking infrastructure lowers the likelihood of using banking services, indicating distance as a significant barrier to financial inclusion (Ghose, 2020). Rehman, 2020; Pradhan et al., 2021; Kanungo and Gupta, 2021; Dwuvedi et al., 2022; Datta, 2023; Gupta and Singh, 2021; Pravez, 2022; Chacko and Baag, 2021 suggest that use of technology could help address this issue by enabling services such as account balance inquiries, transaction history checks, money remittances and online payments, allowing account holders to initiate transactions without visiting physical branches. This could increase the use of banking services even when branches are located at inconvenient distances. However, the adoption of technology presents its own challenges, such as building customer trust in online banking, ensuring Internet access and mitigating risks like fraudulent activities. Therefore, strategies should be developed to improve digital financial literacy, enhancing the use of digital banking services while also addressing the associated risks.

Gender disparity in financial inclusion is another significant concern, as women often face greater barriers to accessing financial services (Aziz et al., 2022; Dar & Ahmed, 2021; Kulkarni & Ghosh, 2021; Mndolwa & Alhassan, 2020). Cultural norms, limited financial literacy, lower income levels and restricted mobility are key factors contributing to this gap. To tackle this issue, targeted measures are essential such as promoting financial literacy programmes specifically for women, creating gender-sensitive financial products and leveraging technology to reach women in remote areas. Additionally, policies should encourage women's economic participation and asset ownership. Addressing these challenges will help bridge the gender gap in financial inclusion and empower women economically.

Research Gap

Numerous studies have been conducted on financial inclusion since this field is not new anymore. However, no studies have been encountered that include penetration of banking services and insurance industry, and participation in the stock market. This study is an attempt to fill this gap by offering an inclusive overview of financial inclusion in India. It assesses banking, insurance and stock market inclusion through ATM penetration, insurance penetration and per capita investment in mutual funds respectively.

Objectives

a. The aim of this study is as follows:

b. To investigate the ATM deployments in each state of India;

c. To investigate the trend of insurance penetration in India;

d. To investigate the penetration of mutual funds across states of India.

Research Methodology

This study is based on secondary data and is descriptive in nature. The necessary information was gathered from pertinent research articles in the literature as well as from the websites of the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Association of Mutual Funds in India (AMFI), Insurance Regulatory and Development Authority of India (IRDAI) and Unique Identification Authority of India (UIAI).

Findings and Discussions

Deployment and Penetration of ATMs, CRMs and WLAs in each state of India

Chart 1 shows that Tamil Nadu, Maharashtra, Uttar Pradesh, Karnataka and Gujarat stand as the top five states, collectively representing 46% of the total deployment of ATMs, CRMs (cash recycling machines) and WLAs (white label ATMs).

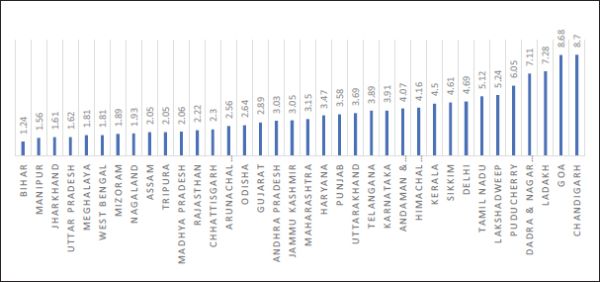

The information regarding the projected population above 18 years of age in 2023 for each state was gathered by the UIAI. The data on the number of ATMs, CRMs and WLAs across states was obtained from the RBI report of December 2023. Chart 2 illustrates the penetration of ATMs across states in India. Goa and Chandigarh rank highest with 8 ATMs, inclusive of CRMs and WLAs, while Bihar ranks lowest in the list.

Chart 1. State Wise Deployments of ATMs, CRMs and WLAs.

.jpg/10_1177_22297561241287598-fig1(1)__600x322.jpg)

Source: RBI Report, December 2023.

Chart 2. ATMs, CRMs and WLAs for Every 10,000 Adults.

Source: Reserve Bank of India Report and Unique Identification Authority of India.

Insurance Penetration and Density in India

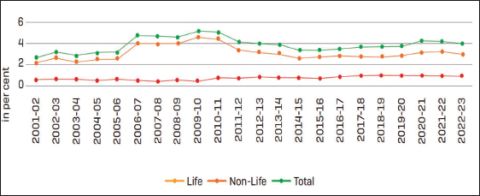

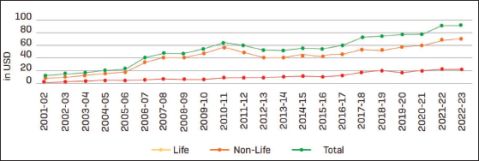

Insurance density and penetration are commonly employed metrics to assess the level of development of an insurance market within a specific country, alongside other indicators. Per capita premium is the metric used to calculate insurance density, which represents the ratio of premiums to population. Conversely, insurance penetration is quantified as the proportion of insurance premiums to gross domestic product (GDP).

Chart 3 shows that in India, the life insurance sector's insurance penetration fell from 3.2% in 2021–2022 to 3% in 2022–2023. The non-life insurance sector's insurance penetration stayed at 1% in both of these years. As a result, India's total insurance penetration fell from 4.2% in 2021–2022 to 4% in 2022–2023.

Chart 4 shows that the life insurance density rose from USD 69 in 2021–2022 to USD 70 in 2022–2023. In contrast, the density of non-life insurance did not change. India's overall insurance density rose from USD 91 in 2021–2022 to USD 92 in 2022–2023 in 2022–2023.

Penetration of Mutual Funds Across States in India

The penetration of mutual funds refers to the level or extent of adoption of mutual funds within a particular region. It indicates the proportion of investors or households that have invested in mutual funds relative to the total population.

Chart 3. Trend in Insurance Penetration in India.

Source: Insurance Regulatory and Development Authority of India (IRDAI) Annual Report 2022-23.

Chart 4. Trend in Insurance Density in India.

Source: Insurance Regulatory and Development Authority of India (IRDAI) Annual Report 2022-23.

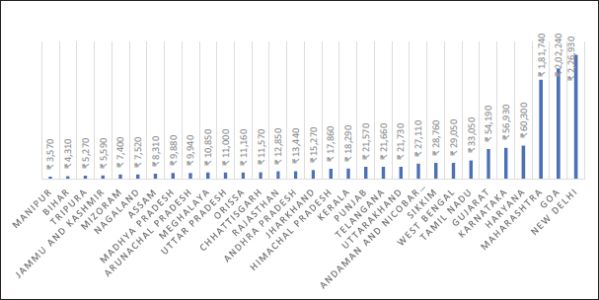

Chart 5 shows that New Delhi, Goa and Maharashtra lead the rankings for per capita investment in mutual funds, with figures standing at Rs. 2,26,930; Rs. 2,02,240; and Rs. 1,81,740 respectively. Conversely, the per capita investment in mutual funds across the six North Eastern states (Manipur, Tripura, Mizoram, Nagaland, Assam and Arunachal Pradesh) falls below Rs. 10,000.

Limitation of the Study

This study aimed to assess financial inclusion across Indian states and union territories, relying entirely on secondary data, with its reliability dependent on the accuracy of the data sources. A significant limitation of using secondary data is that the study's effectiveness is dependent on data availability. Additionally, the assessment focused on only three dimensions – ATM penetration, insurance penetration and mutual fund penetration. The limited scope of these dimensions may impact the overall reliability of the findings.

Chart 5. State Wise Per Capita Investment in Mutual Funds.

Source: Website of the Association of Mutual Funds of India (February 2024).

Direction for Future Research

The existing literature establishes a strong relationship between financial inclusion and inclusive growth. Recognising the significance of financial inclusion, the Government of India has implemented various initiatives to improve access to financial services. However, evaluating the effectiveness of these initiatives at the grassroots level is essential to identify gaps and enhance their impact. Most studies in the literature assess financial inclusion by focusing on the number of bank accounts, savings and credit, incorporating other important dimensions, such as insurance and investment, could provide more comprehensive and reliable insights into the state of financial inclusion. This study attempts to assess financial inclusion across Indian states and union territories by considering three dimensions: the penetration of ATMs, insurance and mutual funds. However, this study is entirely based on secondary data. Future research could use primary data and consider additional dimensions to provide a more holistic assessment of financial inclusion.

Conclusion

This study presents the current state of financial inclusion in India based on ATM deployments, insurance penetration and participation in the stock market. As per the Swiss Re Sigma World Insurance Report, the global overall insurance penetration and density reached 6.8% and USD 853 respectively in 2022. Meanwhile, in India, the overall insurance penetration and density were recorded at 4.2% and USD 92 respectively in 2022. These figures highlight that insurance coverage has not yet reached a significant portion of the population. Bihar, Manipur, Jharkhand, Uttar Pradesh, Meghalaya, West Bengal, Mizoram and Nagaland are the states, where the number of ATMs (including CRMs and WLAs) per 10,000 adult population is below 2. This indicates a need for increased deployment of ATMs in these states. Chart 5 reveals the low per capita investment in mutual funds in the North Eastern states. This underscores the importance of boosting demand for such investment vehicles in the region through increased awareness, financial literacy and financial capability initiatives.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Japil Basumatary  https://orcid.org/0000-0003-0213-9156

https://orcid.org/0000-0003-0213-9156

Aziz, F., Sheikh, S. M., & Shah, I. H. (2022). Financial inclusion for women empowerment in South Asian countries. Journal of Financial Regulation and Compliance, 30(4), 489–502.

Chacko, K. T., & Baag, P. K. (2021). Financial Inclusion in India: An approach through FinTech as a solution (No. 463).

Chafa, A., Gupta, P., & Makadi, Y. C. (2023). A comparative analysis of recent efforts on financial inclusion and the policy recommendations of financial inclusion in India and Nigeria. Journal of Namibian Studies: History Politics Culture, 34, 6386–6398.

Dar, A. B., & Ahmed, F. (2021). Financial inclusion determinants and impediments in India: insights from the global financial inclusion index. Journal of Financial Economic Policy, 13(3), 391–408.

Datta, D. (2023). The future of financial inclusion through fintech: a conceptual study in post pandemic India. Sachetas, 2(1), 11–17.

Ghose, S. (2020). Financial inclusion in India: Does distance matter?. South Asia Economic Journal, 21(2), 216–238.

Gupta, S. (2020). An analysis on progress and prospects of financial inclusion in India. Editorial Board, 9(8), 90–94.

Gupta, S., & Thakur, K. S. (2020). Performance evaluation of financial inclusion in India: with special reference to Pradhan Mantri Jan Dhan Yojana (PMJDY). Innovation and emerging trends in business management and information technology. Jiwaji University May, 1–23.

Kanungo, R. P., & Gupta, S. (2021). Financial inclusion through digitalisation of services for well-being. Technological Forecasting and Social Change, 167, 120721.

Kulkarni, L., & Ghosh, A. (2021). Gender disparity in the digitalization of financial services: challenges and promises for women’s financial inclusion in India. Gender, Technology and Development, 25(2), 233–250.

Mndolwa, F. D., & Alhassan, A. L. (2020). Gender disparities in financial inclusion: Insights from Tanzania. African Development Review, 32(4), 578–590.

Panakaje, N., Rahiman, H. U., Parvin, S. R., Kulal, A., & Siddiq, A. (2023). Socio-economic empowerment in rural India: Do financial inclusion and literacy matters? Cogent Social Sciences, 9(1), 2225829.

Pradhan, R. P., Arvin, M. B., Nair, M. S., Hall, J. H., & Bennett, S. E. (2021). Sustainable economic development in India: The dynamics between financial inclusion, ICT development, and economic growth. Technological Forecasting and Social Change, 169, 120758.

Ratnawati, K. (2020). The impact of financial inclusion on economic growth, poverty, income inequality, and financial stability in Asia. The Journal of Asian Finance, Economics and Business, 7(10), 73–85.

Rehman, A. (2020). Innovation and management by regional rural banks in achieving the dream of financial inclusion in India: Challenges and prospects. Marketing and Management of Innovations. DOI:10.21272/mmi.2020.1-18

Sil, N. (2020). Research perspectives on financial inclusion for inclusive growth in India. Asian Journal of Economics, Finance and Management, 304–325.

Singh, K., & Gupta, N. (2020). Financial inclusion in India-A review. Indian Journal of Economics and Development, 16(2), 278–284.

Steffi, I. J., & Balkees, N. (2020). An overview of financial inclusion on poverty alleviation in India. Our Heritage UGC Care Listed Journal, 68(2), 187–196.

Tiwari, C., Goli, S., Siddiqui, M. Z., & Salve, P. S. (2022). Poverty, wealth inequality and financial inclusion among castes in Hindu and Muslim communities in Uttar Pradesh, India. Journal of International Development, 34(6), 1227–1255.

https://uidai.gov.in/images/StateWise_AadhaarSat_Rep_31082023_Projected-2023-Overall.pdf

https://www.amfiindia.com/geographical-spreads

https://irdai.gov.in/annual-reports

https://rbi.org.in/Scripts/StateRegionATMView.aspx

https://www.worldbank.org/en/topic/financialinclusion/overviewJo