1Department of Economics, Dennis Osadebay University, Asaba, Delta State, Nigeria

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The research examined the impact of digital financial sustainability and institutional quality on economic growth. The research is founded on 26 chosen Sub-Saharan African (SSA) nations, and the data available span 1993–2023. The generalised linear model estimation technique was used. The results show that private sector credit and access to credit to the private sector positively and significantly affect growth in SSA nations. Broad money supply has a positive yet not significant impact on economic growth. Automated teller machine (ATM) penetration level increase and an increase in the account holder population have a positive impact on economic growth, while high dissemination of bank deposit and lending rate has a negative impact on economic growth. It has been found by this study that digital financial sustainability has not played a significant role in economic growth in SSA nations. However, the results of the interactive effect of digital financial sustainability on both political stability and government effectiveness have a positive effect on economic growth in SSA countries. The article suggests institutional quality improvement in the dimension of government effectiveness and political stability and improved access to credit facilities for the achievement of sustainable economic growth in SSA countries.

Digital financial sustainability, economic growth, institutional quality, Sub-Saharan African countries

Introduction

Attaining inclusive and sustainable growth is a critical global concern; however, developing countries need to focus on effectively tackling this phenomenon. The role of digital innovation and financial sustainability (henceforth: DIFS) in the growth process has garnered attention from stakeholders and policymakers alike. DIFS entails financial access usage and penetration. DIFS has been considered a veritable means to attaining Sustainable Development Goals. DIFS possesses the capacity to accentuate the economic growth of developing countries by offering digital solutions that not only improve financial exclusion but also access to financial services (Allen et al., 2016; Kooli et al., 2022).

Digital financial inclusion (DIFI) is the provision of access to financial services using digital solutions. It therefore entails the process of ensuring that financial services are not just accessible to all individuals but are usable by them (Abu, 2024). Digital financial services can be accessed via internet platforms, mobile devices or other digital channels, and can include digital payments, savings accounts, investment options, credit and insurance (Bustinza et al., 2024). Countries that invested more in sustainability record a low level of financial exclusion and are most likely to withstand economic challenges (Khera et al., 2021; Thaddeus et al., 2020; Wysokińska, 2021). The pinpoint is that greater investment in digital solutions may result in broader access to financial services and a more financially and economically resilient economy. Digital finance has the capacity to reduce the level of social deprivation in an economy, which in turn reduces unemployment. Financial deepening and innovation mobilise savings, lower the cost of financial intermediation, improve government expenditure and offer funding for growth (Chinoda & Kapingura, 2024).

In recent years, Sub-Saharan African (SSA) countries have prioritised enhancing digital finance to spearhead and drive inclusive economic growth. However, challenges continue as the growth rate attained by several countries appears to be compromised by a high level of poverty, inequality and unemployment. While generally beneficial for economic growth, the contribution of digital finance to economic growth may be engendered by institutional quality (Emara & Chiu, 2015; Laeven et al., 2015; Nkoa & Song, 2020). This is an indication that institutional quality is crucial for enhancing the economic growth of SSA countries. Improved institutional quality in the form of good governance and political stability in SSA countries promotes economic growth and the well-being of the citizens (Liu & Zhang, 2024; Ozturk & Ullah, 2022).

This study examines the role of digital financial sustainability and institutional quality in the economic growth of SSA countries based on the generalised linear model (GLM) estimation method using data from 1993 to 2023. The results indicate that private sector credit and private sector access to credit have a positive and significant effect on economic growth. Broad money supply exerted a positive effect on economic growth, though not statistically significant. An increase in the penetration rate of automated teller machines (ATMs) and an increase in the number of account holders have a positive effect on economic growth, while a high bank deposit and lending rate have a negative effect on economic growth. Political stability and government effectiveness interactive effect on digital financial sustainability have a positive effect on economic growth. These findings are insightful because of the potential nexus between digital finance and effective institutional quality, which can guide policymakers in the design of targeted strategies to accentuate economic growth.

Existing studies have examined the relationship between financial development and economic growth. While Kanga et al. (2021), Chen et al. (2022), Song and Appiah-Otoo (2022), Sreenu and Verma (2024), Bu et al. (2023) and Ngong et al. (2024) reported that financial development and innovation is good for growth, Rousseau and Watchtel (2011), Law and Singh (2014), Swamy and Dharani (2019) and Zhu et al. (2020) found that financial development and innovation reported opposing view. Although few studies have linked financial development with instructional quality such as democracy and governance, the role of political stability and government effectiveness remains relatively unexplored. In filling this research gap, this study examines the link between financial development innovation, institutional quality indicators and economic growth.

This study is further structured into four parts. The second section deals with literature review. The third section deals with the research method, the fourth section gives results and discusses findings, and the fifth section sums up the study, concludes and offers policy recommendations.

Review of Literature

Existing growth theories postulate that economic growth in a country is driven by different factors. The Solow Growth Model, which forms the foundation for the modern theory of economic growth, assumes that economic growth is exogenously determined. The model analysed changes in the level of output attributed to labour productivity, savings and technological progress. Exertion of the exogenous growth model was propounded by the Solow–Swan growth axiom. The model explains the role of capital accumulation, labour and increase in productivity largely influenced by technological progress and long-term growth. The neoclassical growth theory postulates that capital accumulation and its efficient utilisation are important for determining economic growth. The theory opines that technology combined with labour productivity increases total output through increased productivity of labour. Adopting a variant of the Cobb–Douglas production function, the relationship as envisaged by the neoclassical growth model is expressed as:

(1)

(1)

where:

Z = total output, which is also dubbed gross domestic product (GDP);

Ć = capital;

Ĺ = labour;

A = level of technology

Schumpeter (1912) advanced the growth theorem by connecting financial development and economic growth. The thesis is that labour, capital, technological progress and fintech drive economic growth. The Schumpeter growth model has been extended by other researchers including Bencivenga and Smith (1991), King and Levine (1993a, 1993b), Aghion et al. (2015) and Bofinger et al. (2021). Thaddeus et al. (2020), Ahmed et al. (2021), Khera et al. (2021), Banna et al. (2020) and Ahmed et al. (2021) contend that digital financial development contributes positively to economic growth. Banna et al. (2020) established that digital financial inclusion contributed to the economic growth experienced by 22 Asian countries between 2011 and 2018. Kanga et al. (2021) examined the impact of fintech on economic growth. It was found that fintech had a positive impact on economic growth.

Cevik (2024) found that fintech plays an important role in economic growth based on the kind of fintech investment. Nevertheless, the net effect still remains statistically significant. As shown, a 1% rise in the average size of fintech caused a 55% rise in GDP. Ngeze and Sei (2024) used quantitative quarterly time series data spanning the Tanzanian era between 2008 and 2022. The findings indicate that fintech has made a positive impact on the national economy and per capita growth. Wu-Po and Ya-Ching (2024) informed us that the positive effect of fintech on economic growth is higher during times of crisis. In general, the results indicate that fintech is significant in mitigating the adverse effects of crises on economic growth. Ngong et al. (2024) made an empirical study of the causality of economic growth and financial technology in the East African Community nations based on 1997–2019 data. The result indicated that there was a bidirectional causality between ATM and economic growth and a unidirectional causation of economic growth to point of sale (POS) and internet banking, mobile banking and government effectiveness to economic growth. This result suggests that in the long run, there is a convergence between economic development and fintech. Thaddeus et al. (2020), however, found that causality only runs from economic development to digital financial inclusion. Additional research like Li and Wong (2018), Beck et al. (2000), Zhang et al. (2023), Chen et al. (2022), Song and Appiah-Otoo (2022) and Bu et al. (2023) also report a statistically significant positive connection between fintech and economic growth.

Zhu et al. (2020) employed a dynamic panel threshold approach and examined the potential non-linearity among finance, innovation and economic growth. It was found that financial development has not been a major driver of economic growth. Swamy and Dharani (2019) analysed the contribution of finance to economic growth in developed countries for the period 1983–2013. The findings offer evidence of long-run non-linearity between finance and economic growth. Rousseau and Wachtel (2011), Cecchetti and Kharroubi (2012), Law and Singh (2014) and Arcand et al. (2015) found that finance contributes minimally to economic growth.

Some research has also confirmed that effective credit supply propels economic growth, whereas low financial development and its resulting inefficient private sector credit system retard economic growth. Amoo et al. (2017) analysed the effect of private sector credit on economic growth in Nigeria through fully modified least squares. Credit was discovered to promote economic growth. Olowofeso et al. (2015) discussed the effects of private sector credit on economic growth in Nigeria. The research concluded that private sector credit had a positive and significant effect on growth, whereas a higher prime lending rate slows down economic growth.

Fisman and Love (2007) point out that a country with quality institutions and higher levels of financial development will likely experience faster growth. Likewise, Laeven et al. (2015) found that financial innovation boosts economic growth through better institutional quality. Pal et al. (2025) stressed that an economy can only function optimally with a robust institution. High-quality institutions provide an efficient legal and regulatory environment that fosters efficient allocation of financial resources and economic performance. This in turn encourages more people to access digital financial services. However, poor institutional quality hinders the adoption and effectiveness of digital financial services. World Bank (2018) avers that institutional failures most often lead to resource misallocation, market inefficiencies, a high level of financial exclusion and a reduction in economic growth rate. Yiadom et al. (2021) found that efficient institutional quality reduces financial exclusion and poverty rate. Nkoa and Song (2020) reported that institutional quality improves access to financial services. Maruta et al. (2020) assert that as the extent of institutional quality improves, the more the economy grows. Siyakiya et al. (2023) reported that, for an economy’s degree of financial development to stimulate economic growth, the institutional quality must be robust. Sreenu and Verma (2024) articulate that the significant impact of fintech on economic growth can be enhanced by the existence of regulatory mechanisms. This implies that the role of fintech in promoting economic growth, especially in developing economies, can be enhanced by strengthening institutions.

From the literature, there are indications that the quality of institutions is paramount to the role of digital financial inclusion to accentuate economic growth. However, there is a paucity of studies linking digital financial inclusion, quality of institutions and economic growth in SSA countries.

Study Method, Data and Estimation Strategy

Methodological Framework Underlying the Model Specification

The model specification of this study is drawn from the Schumpeter (1912) growth theorem. The theoretical exposition of the growth model is that financial development and innovation are linked with economic growth. It is theorised that beyond labour, capital and technological progress, fintech is an engine of growth. The Schumpeter growth theorem provides a suitable framework for analysing the finance and growth nexus.

The study examines the effect of digital financial sustainability and institutional quality on economic growth. Accordingly, variables of interest are financial sustainability, institutional quality indicators and economic growth. Following the Schumpeter (1912) growth model, Equation (1), which provides the theoretical connection among the variables, can be re-specified to incorporate financial sustainability and institutional quality as:

(2)

(2)

where:

Q = output (economic growth);

FINTECH = financial technology;

INSQ = institutional quality;

N = control variables

The expanded model expressing the relationship between the dependent and explanatory variables is expressed in panel form as:

(2)

(2)

where:

Q = output, indicator for economic growth;

DFS = digital financial sustainability;

INSQ = institutional quality;

X .png) Y = interactive terms;

Y = interactive terms;

.png) = control variable;

= control variable;

.png) = error term, with its usual features.

= error term, with its usual features.

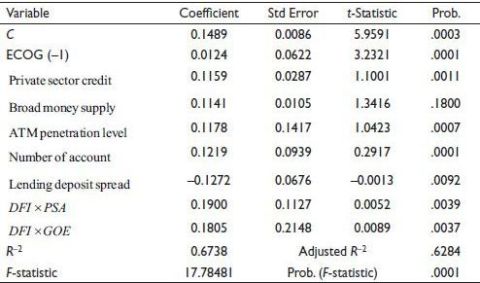

Arising from Equation (2) and considering the variables under consideration in this study, the model for empirical estimation is expressed as:

(3)

(3)

where:

ECOG = economic growth (GDP per capita, annual growth);

PSCR = private sector credit;

BMS = broad money supply;

VAH = number of account holders;

ATP = ATM penetration level,

LDS = lending deposit spread;

DFI * PSA = DFI interaction with political stability;

DFI * GOE = FDI interaction with government effectiveness.

Data and Estimation Strategy

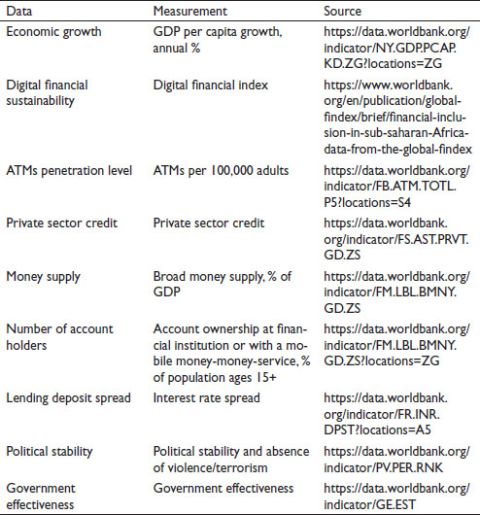

Data for this study cover 26 SSA countries for the period 1993–2023. The list of countries included in the study is in the Appendix. These countries were selected because they are prominent hubs for tech innovation. Besides, these countries were those that have showcased significant improvement in overall governance.

As showcased in the model for empirical estimation, economic growth is the dependent variable. The explanatory variables are digital financial sustainability and the index of selected institutional quality. For robustness, digital financial sustainability covers financial access usage and penetration, and it is measured by private sector credit to GDP, broad money supply expansion, lending-deposit spread, automated teller machine penetration (ATP), number of active account holders per 100,000 adults and mobile subscription as reported by World Bank and G20 Financial Inclusion Indicator. Institutional quality is measured by political stability and government effectiveness. They provide more insight into the institutional reforms in the selected SSA countries and how they interplay between DIFI and economic development.

As an estimation strategy, this study adopted the dynamic panel regression (system GLM) as suggested by Arellano and Bover (1995). The dynamic panel regression (system GLM) enables the explanatory variable to be treated as potentially endogenous or exogenous.

Empirical Results and Discussion

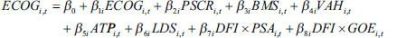

The results of the various preliminary tests conducted are presented in Table 1.

In Table 1, SSA countries witnessed an average growth rate of 3.18% and a standard deviation of 7.72 for the study period. Also, the least economic growth rate recorded by the countries was 1.01% and the highest growth rate was 5.47%. Private sector credit, broad money supply, ATP level, volume of account holders and lending deposit spread exhibited respective mean values of 15.91%, 26.21%, 25.36%, 28.53% and 8.97%, but deviated by 12.44%, 15.60%, 20.13%, 26.20% and 8.16%, respectively. From the correlation analysis, ATP level is directly related to economic development. The correlation coefficient value is estimated at 0.7588. Broad money supply is directly related to sustainable economic development in SSA countries, and that such relationship is moderate with a correlation value of 0.6576. Furthermore, lending deposit spread and government effectiveness have a low yet negative correlation with sustainable economic development. However, PSCR, volume of account holders and political stability have a low yet positive correlation with economic growth.

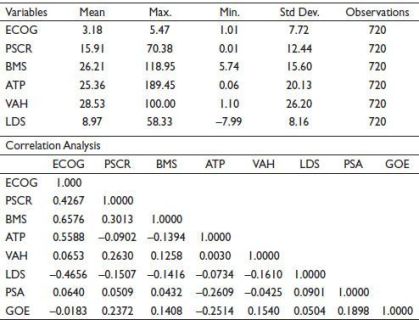

Based on the outcome of the various diagnostic tests above, the study adopted the GLM estimation strategy to test the research hypotheses as it is a more suitable inferential statistics faced with normality issues than the fixed effect model. This is premised on the fact that it permits non-normal stochastic and non-linear systematic components. The results are presented in Table 2.

The result in Table 2 suggests that private sector credit had a positive and significant impact on economic growth. This is a pointer that private sector credit induces economic growth in SSA nations. This aligns with the evidence of Amoo et al. (2017) and Olowofeso et al. (2015). These studies have also evidenced that efficient delivery of credit triggers economic growth, whereas deficient financial development and its concomitant inefficient private sector credit mechanism discourage economic growth. Supply of broad money positively affects economic growth, albeit marginally. The study validates the supply-leading hypothesis that there is a reciprocal relationship between finance and stable economic development. Also, ATP is positively contributing to economic growth.

Table 1. Summary of Descriptive Statistics.

Table 2. Generalised Linear Model (GLM) Results on the Effect of Digital Financial Inclusion and Institutional Quality on Economic Growth in Sub-Saharan African (SSA) Countries.

ATM, to a large extent, is seen as a new and reliable technology that has significantly contributed to business transactions in urban and rural areas, thus contributing to economic growth. The finding also revealed that economic development growth in the number of account holders relates to a 0.12% growth in economic development. The result is in agreement with Ngong et al. (2024), which also demonstrated that ATM has been responsible for the economic growth of the East African Community states. On the other hand, high widespread of bank deposit and lending rate retarded economic growth. This is an implication that high widespread of bank deposit and lending increases investment that retards economic activities. This justifies the argument that high lending rate undermines economic growth. In an examination of the impact of private credit on economic growth in Nigeria, Olowofeso et al. (2015) also indicated that raising prime lending rate slows down growth.

Generally, the outcome is a reflection of the fact that economic sustainability in the era of technology has a negligible effect on SSA country economic growth.

This corresponds with the work of prior literature such as Swamy and Dharani (2019), Zhu et al. (2020), Cecchetti and Kharroubi (2012), Law and Singh (2014) and Arcand et al. (2015) that fintech does not have a major role to play in economic growth. Our finding, however, contradicts prior works. For example, Thaddeus et al. (2020), Ahmed et al. (2021), Khera et al. (2021), Banna et al. (2020) and Ahmed et al. (2021) established that digital financial inclusion has a positive correlation with economic growth. Kanga et al. (2021) established a positive correlation between fintech and economic growth in 137 countries over the period 1991–2015. Cevik (2024) discovers that fintech significantly impacts economic growth. Ngeze and Sei (2024) similarly discovered that fintech has improved the national economy alongside per capita growth in Tanzania. Scholars such as Li and Wong (2018), Beck et al. (2000), Zhang et al. (2023), Chen et al. (2022), Song and Appiah-Otoo (2022) and Bu et al. (2023) similarly discover that fintech significantly and positively impacts economic growth.

The outcome of the respective interactive impact of financial sustainability, government effectiveness and political stability is a positive impact on economic development. This is an emphasis that with proper institutions, digital financial sustainability can highlight economic development of SSA nations. Our findings are in support of Yiadom et al. (2021) and Sreenu and Verma (2024) that increased institutional quality increases the role of fintech towards economic growth. Fisman and Love (2007) and Laeven et al. (2015) established that financial innovation contributes to economic growth, particularly through increased institutional quality. Siyakiya et al. (2023) have stated that, if monetary development in an economy is to drive economic growth, then institution quality has a convincing presence. This is evidence that the involvement of fintech in supporting economic growth, particularly in SSA nations, can be boosted by improving institutions.

Conclusion and Recommendations

This essay presents evidence on the effects of digital financial sustainability and institutional quality towards economic growth in SSA nations. The research time frame was from 1993 to 2023. The GLM estimation approach was used. The findings show that private sector credit significantly and positively affected economic growth. This is an indication that private sector credit promotes economic growth in SSA nations. This agrees with the findings of Amoo et al. (2017) and Olowofeso et al. (2015). These works have also revealed that effective provision of credit enhances economic growth, while an inefficient private sector credit system and a low degree of financial development stifle economic growth. Provision of broad money is positively correlated with economic growth, albeit minor. Besides, ATP positively contributes to economic development. ATM is generally seen as an advanced and reliable technology that has highly facilitated business transactions to be very convenient in urban and rural locations, hence promoting economic development. The outcome also showed that a 0.12% increase in economic progress is attributed to growth in the population of account holders. The results are in agreement with Ngong et al. (2024) that ATM has played a great role in economic development in the East African Community member states. There was an extensive spread of bank deposit and lending rate which affected economic growth negatively. This is indicative that an extensive spread of bank deposit and lending rise holds back investment that suppresses economic activity. This underscores the argument that a high lending rate threatens economic growth. In analysing the impact of private credit on economic growth in Nigeria, Olowofeso et al. (2015) also confirmed that a rising prime lending rate postpones growth. Generally, the finding is that digital financial sustainability has a minimal impact on economic growth in SSA countries. This agrees with the results of prior research like Swamy and Dharani (2019), Zhu et al. (2020) and Law and Singh (2014), and Arcand et al. (2015), which state that fintech has not been responsible for any major economic growth. Our research result disagrees with prior research. For example, Thaddeus et al. (2020), Ahmed et al. (2021), Khera et al. (2021), Banna et al. (2020) and Ahmed et al. (2021) mentioned that digital financial inclusion has a positive correlation with economic growth. Kanga et al. (2021) concluded the positive relationship between fintech and economic growth in 137 nations from 1991 to 2015. Some other studies like Li and Wong (2018), Beck et al. (2000), Zhang et al. (2023), Chen et al. (2022), Song and Appiah-Otoo (2022) and Bu et al. (2023) also conclude that fintech had a significant and positive contribution to economic growth. The implication of the simultaneous interactive effect of digital financial sustainability, government effectiveness and political stability is a positive contribution to economic growth. This is a pinpoint that in the case of quality institution, digital financial sustainability can highlight economic growth in SSA countries. Our findings corroborate Yiadom et al. (2021) and Sreenu and Verma (2024) who provide evidence that the quality of institutions increases the role played by fintech in economic growth. Siyakiya et al. (2023) found that for the financial development of an economy to be able to drive economic growth, the institutional quality needs to be strong. This is reflective that institution-building can increase the contribution of fintech towards economic growth, particularly in SSA nations. The research concludes that institutional quality and digital financial sustainability are extremely important to the achievement of sustainable economic growth in SSA countries.

The article suggests institutional quality improvement in the dimension of government effectiveness and political stability and improved access to credit facilities for the achievement of sustainable economic growth in SSA countries.

Scope for Future Studies

This study is limited by its inability to cover all SSA countries. Future studies considering financial sustainability, institutional quality and economic growth are therefore suggested to cover more or all SSA countries.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Richardson Kojo Edeme  https://orcid.org/0000-0001-8396-9316

https://orcid.org/0000-0001-8396-9316

Abu, N. I. (2024). Financial inclusion and economic development, African Banking and Finance Review Journal, 13(13), 43–62.

Aghion, P., Akcigit, U., & Howitt, P. (2015). Lessons from Schumpeterian growth theory. American Economic Review, 105(5), 94–99.

Ahmed, K., Khan, B., & Ozturk, I. (2021). Dynamics between disaggregates of governance and stock market performance in selected South Asia countries. International Journal of Finance and Economics, 26(1), 802–813.

Allen, F., Demirguc-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation, 27(1), 1–30.

Amoo, G. B. A., Eboreime, M. I., Adamu, Y., & Belonwu, M. C. (2017). The impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 8(2), 1–22.

Arcand, J I., Berkes, E., & Panizza, U. (2015). Too much finance? Journal of Economic Growth, 20(2), 105–148. https://doi.org/10.1007/s10887-015-9115-2

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Banna, H., Hassan, M. K., & Alam, M. R. (2020). Digital financial inclusion, Islamic banking stability and sustainable economic growth. In Islamic perspective for sustainable financial system (pp. 131–152).

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1), 261–300.

Bencivenga, V., & Smith, B. (1991). Financial intermediation and endogenous growth. Review of Economic Studies, 58(2), 195–209.

Bofinger, P., Geißendörfer, L., Haas, T., & Mayer, F. (2021). Discovering the true Schumpeter-new insights into the finance and growth nexus (CEPR Discussion Paper No. 16851).

Bu, Y., Yu, X., & Li, H. (2023). The nonlinear impact of Fintech on the real economic growth: Evidence from China. Economics of Innovation and New Technology, 32(8), 1138–1155.

Bustinza, H. D. A., de Souza, B., De la Cruz Rojas, R. Bustinza H. D., A. (2024). Inclusive economic growth. In International trade and inclusive economic growth (pp. 19–64). Emerald Publishing Limited.

Cecchetti, G., & Kharroubi, E. (2012). Reassessing the impact of finance on growth. Bank for International Settlements (BIS) Working Papers No. 381, Bank for International Settlements, Basel, Switzerland.

Cevik, S. (2024). Is Schumpeter right? Fintech and economic growth (International Monetary Fund Working Paper, WP/24/20).

Chen, X., Teng, L., & Chen, W. (2022). How does fintech affect the development of the digital economy? Evidence from China. North American Journal of Economics and Finance, 61(C), 101697.

Chinoda, T., & Kapingura, F. M. (2024). Digital financial inclusion and economic growth in Sub-Saharan Africa: The role of institutions and governance. African Journal of Economic and Management Studies, 15(1), 15–30.

Emara, N., & Chiu, I.-M. (2015). The impact of governance on economic growth: The case of Middle Eastern and North African countries. Economic Systems, 39(2), 186–202. https://doi.org/10.1016/j.ecosys.2014.05.002

Fisman, R., & Love, I. (2007). Financial dependence and economic growth revisited. Journal of European Economic Association, 5(2–3), 470–479.

Kanga, D., Oughton, C., Harris, L., & Murinde, V. (2021). The diffusion of fintech, financial inclusion and income per capita. European Journal of Finance, 28(1), 108–136.

Khera, P., Ng, M. S. Y., Ogawa, M. S., & Sahay, M. R. (2021). Is digital financial inclusion unlocking growth? International Monetary Fund.

King, G. R., & Levine, R. (1993a). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737.

King, G. R., & Levine, R. (1993b), Finance, entrepreneurship and growth. Journal of Monetary Economics, 32(3), 513–530.

Kooli, C., Shanikat, M., & Kanakriyah, R. (2022). Towards a new model of productive Islamic financial mechanisms. International Journal of Business Performance Management, 23(1–2), 17–33.

Laeven, L., Levine, R., & Michalopoulos, S. (2015). Financial innovation and endogenous growth. Journal of Financial Intermediation, 24(1), 1–24. https://doi.org/10.1016/j.jfi.2014.04.001

Law, S., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking and Finance, 41(C), 36–44.

Liu, S., & Zhang, H. (2024). Governance quality and green growth: New empirical evidence from BRICS. Finance Research Letters, 65, 105566. https://doi.org/10.1016/j.frl.2024.105566

Li, C., & Wong, J. C. (2018). Financial development and inclusion in the Caribbean. International Monetary Fund (IMF) Working Paper WP/18/53, International Monetary Fund, Washington.

Maruta, A. A., Banerjee, R., & Cavoli, T. (2020). Foreign aid, institutional quality and economic growth: Evidence from the developing world. Economic Modelling, 89, 444–463.

Ngeze, R. M., & Sei, M. (2024). The impact of financial technology (Fintech) on economic growth: Evidence from Tanzania. African Journal of Economics and Business Research, 3(2), 1–27.

Ngong, C. A., Thaddeus, K. J., & Onwumere, J. U. J. (2024). Financial technology and economic growth nexus in the East African community states. Journal of Economics, Finance and Administrative Studies, 29(58), 263–276. https://doi.org/10.1108/JEFAS-01-2022-0009

Nkoa, B. E. O., & Song, J. S. (2020). Does institutional quality affect financial inclusion in Africa? A panel data analysis, Economic Systems, 44(4), 100836.

Olowofeso, E. O., Adeleke A., O., & Udoji, A. O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81–101.

Ozturk, I., & Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis, Resources, Conservation and Recycling, 85(1), 106489.

Pal, S., Vankila, S., & Fernandes, M. N. (2025). Interplay of financial inclusion and economic growth in emerging economies. World Development Sustainability, 6(100201), 1–14, https://doi.org/10.1016/j.wds.2025.100201

Rousseau, P., & Wachtel, P. (2011). What is happening to the impact of financial deepening on economic growth? Economic Inquiry, 49(1), 276–288.

Schumpeter, J. A. (1912). The theory of economic development. Routledge.

Siyakiya, P., Erdoğdu, M. M., & Akay, E. Ç. (2023). Impact of industrialization on economic development in selected African and Asian economies: The role of institutional quality and investment climate. SN Business & Economics, 3(12), 211.

Song, N., & Appiah-Otoo, I. (2022). The impact of fintech on economic growth: Evidence from China. Sustainability, 14(10), 1–7.

Sreenu, N., & Verma, S. S. (2024). Enhancing economic growth through digital financial inclusion: An examination of India. Transnational Corporations Review, 16(4), 200091. https://doi.org/10.1016/j.tncr.2024.200091

Swamy, V., & Dharani, M. (2019). The dynamics of finance-growth nexus in advanced economies. International Review of Economics and Finance, 64(C), 122–146.

Thaddeus, K., Ngong, C., & Manasseh, C. (2020), Digital financial inclusion and economic growth: Evidence from Sub-Saharan Africa (2011-2017). International Journal of Business and Management, 8(4), 212–217.

World Bank. (2018). UFA2020 overview: Universal financial access by 2020. https://www.worldbank.org/en/topic/financialinclusion/brief/achieving-universal-financial-access-by-2020

Wu-Po, L., & Ya-Ching, C. (2024). FinTech, economic growth, and COVID-19: International evidence. Asia Pacific Management Review, 29(3), 362–367. https://doi.org/10.1016/j.apmrv.2023.12.006

Wysokińska, Z. (2021). A review of the impact of the digital transformation on the global and European economy. Comparative Economic Research. Central and Eastern Europe, 24(3), 75–92.

Yiadom, E. B., Dziwornu, R. K., & Yalley, S. (2021). Financial inclusion, poverty and growth in Africa: Can institutions help? African Journal of Economic and Sustainable Development, 8(9), 91–110.

Zhang, G. J., Chen, Y., Wang, G. N., Zhou, C. S. (2023). Spatial-temporal evolution and influencing factors of digital financial inclusion: county-level evidence from China. Chinese Geographical Science, 33(2), 221–232. https://doi.org/10.1007/s11769-023-1333-5”10.1007/s11769-023-1333-5

Zhu, X., Asimakopoulos, S., & Kim, J. (2020). Financial development and innovation-led growth: Is too much finance better? Journal of International Money and Finance, 100(C), 1020.

Appendix: Data Sources.

List of countries included in the study:

Angola, Cameroon, Comoros, Botswana, Uganda, Cape Verde, Egypt, Zimbabwe, Congo Rep, Guinea, Guinea-Bissau, Ghana, Lesotho, Madagascar, Mali, Malawi, Morocco, Kenya, Nigeria, Rwanda, Namibia, Eswatini, Seychelles, Uganda, South Africa and Zambia.