1Indian Institute of Technology (Indian School of Mines) Dhanbad, Jharkhand, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This commentary aims to examine the influence of gender on the accessibility of microloans in North Eastern Region (NER), India. Using data obtained from 200 entrepreneurs from NER, the article employed the logit model to address two key questions: (a) Does gender play an important role in access to finance? And (b) What is the role of Self-help Groups and education in access to finance? In the light of these research questions, findings from 200 small businesses are presented. The findings of the empirical analysis revealed that firm size, educational qualifications and gender of small business owners play a significant role in the accessibility of microcredit from financial institutions.

Microcredit, women entrepreneurship, gender, firm size, access to finance

Originating from the visionary efforts of Professor Muhammad Yunus in the 1980s, notably through the Grameen Bank, microcredit stands as a beacon of hope for aspiring entrepreneurs, particularly women, globally and across the South Asian landscape. Its revolutionary impact not only facilitates the evolution of businesses from informal to formal sectors but also acts as a catalyst for economic advancement. However, within its narrative of success lies a darker face. Scholars and human rights advocates have raised criticisms, shedding light on ethical crises within microfinance institutions (MFIs), pointing to exploitative lending practices that create a vicious debt trap and particularly impacting marginalised women.

Various studies and evidence suggest that government oversight plays a pivotal role in establishing ethically responsible MFIs and other financial services in the country. Gender discrimination remains an unsolved puzzle in various sectors, and the financial sector is no surprise either. The rising downtrodden and discriminated women populations in education, business and services further contribute to poverty and a lack of awareness of the services, emphasising the urgent need to dissect gender-based disparities in accessing financial services, specifically microcredit.

Despite continuous efforts through policy suggestions and rigorous government schemes such as the Mahila Udyam Nidhi (MUN), Annapurna and Udyogini schemes, gender disparities still prevail in entrepreneurship, especially regarding access to credit. Women entrepreneurs encounter barriers in securing bank loans due to the discriminatory approach towards female entrepreneurs within financial institutions. Empirical evidence shows that women-owned enterprises face challenges in accessing small-business credit and lack financial knowledge or awareness compared with their male counterparts. However, a systematic and unbiased credit system in some rural regions of India has a demonstrable positive impact on informal and small businesses, particularly encouraging women entrepreneur.

The article concentrates on North Eastern Region (NER), India, because it is urgently necessary to eliminate gender-based disparities and recognise the impact of financial literacy on microcredit accessibility. The region is politically, commercially and demographically isolated from other regions in India. The research problem aims to understand the profound impact of gender and financial awareness on microcredit accessibility in this region. This investigation aims to fill a significant gap in the existing literature by exploring the complex relationships among gender dynamics, financial awareness and the accessibility of microcredit, providing broad insights into the challenges faced by small business owners in NER, India. Therefore, this article aims to address two questions: (a) Does gender play an important role in access to finance? And (b) What is the role of Self-help Groups (SHGs) and education in access to finance?

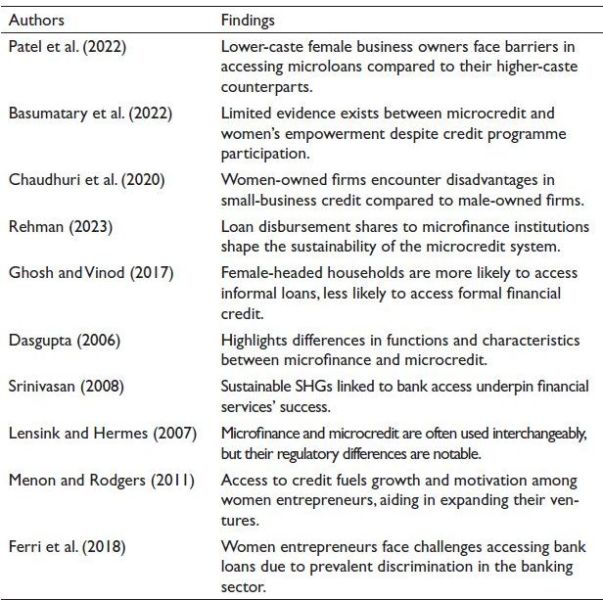

Table 1 condenses the key insights from various studies, showcasing the diverse findings on gender disparities, discrimination and access to credit and the impact of microfinance on different segments of entrepreneurs in India.

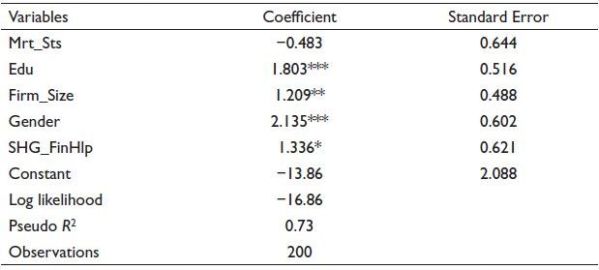

In the light of the research questions mentioned before and the existing literature review, we now report the econometric analysis in Table 2.

Factors Determining Access to Microloan by Women Entrepreneurs in NER

Gender Disparity and Financial Inclusion

The article significantly contributes to the existing literature on gender disparity within the financial system around the world in general and in mainland India in particular. The findings of this study show the prevailing gender bias in the NER of the country, by taking observations from the NER. The theoretical implication lies in highlighting the persistent barrier that hinders financial inclusion.

Table 1. Overview of the Existing Literature

Table 2. Factor Determining Access to Microcredit (Logit Regression) instead of Probit Regression, it should be Logit Regression.

Note: ***, ** and * indicate significances at the 1%, 5% and 10% levels, respectively (***p < .01, **p < .05, *p < .10).

Role of SHGs

The role and significant impact of the SHGs in moulding women’s entrepreneurship in rural and remote regions of India cannot be excluded. Acknowledging this from the existing literature and from the findings of this study, the insights propose theoretical landscape by documenting and advocating the intermediary and collaborative role of the SHGs and financial institutions in building the social infrastructure to help marginalised female entrepreneurs access microcredit.

Firm Dynamics and Education

Firm size and the qualification of the entrepreneur play a significant role as deciding factors in the accessibility of microcredit, along with the gender of the entrepreneur. The findings advocate for contributing to the theoretical understanding of the business landscape in the NER, which is no different from any other region in deliberately excluding its female entrepreneurs from microcredit access. The article draws more compelling insights into understanding the relationship between firm dynamics, individual educational qualifications and the accessibility to microcredit from financial institutions.

Conclusion and Policy Suggestions

The study relying on the data of small and informal business owners revealed that male entrepreneurs are more likely to access microloans than female entrepreneurs, which is consistent with the findings of existing empirical studies. The findings of our article also highlight the complex relationship of factors influencing microcredit accessibility, prominently highlighting educational qualifications, firm dynamics and the collaborative role of SHGs and financial institutions in helping women entrepreneurs in accessing microcredit. Although schemes like MUN by the Government of India have accelerated the growth of women’s entrepreneurship in India, a more inclusive financial model aligned with the demographic and sociopolitical ethos of NER entrepreneurs is needed. Thus, considering policy suggestions, the article strongly advocates for an inclusive financial model to alleviate the marginalised female entrepreneurs in the NER in particular and India in general.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Ashraf Rehman  https://orcid.org/0000-0002-3702-3797

https://orcid.org/0000-0002-3702-3797

Basumatary, H., Chhetri, P. C., & Raj, R. S. N. (2022). Hitting the target, mission the point? Microcredit and women empowerment in rural India. Journal of Poverty, 27(3), 217–234.

Chaudhuri, K., Sasidhara, S., & Raj, R. S. N. (2020). Gender, small firm ownership, and credit access: Some insights from India. Small Business Economics, 54(4), 1165–1181.

Dasgupta, R. (2006). An architectural plan for microfinance institutional network. Economic & Political Weekly, 41(11), 1905–1100.

Ferri, L., Ginesti, G., Spano, R., & Zampella, A. (2018). Exploring the entrepreneurial intention of female students in Italy. Journal of Open Innovation, 4(27), 1–10.

Ghosh, S., & Vinod, D. (2017). What constrains financial inclusion for women? Evidence from Indian micro data. World Development, 92, 60–81. https://doi.org/10.1016/j.worlddev.2016.11.011

Lensink, R., & Hermes, N. (2007). The empirics of microfinance: What do we know? The Economic Journal, 117(517), F1–F10.

Menon, N., & Rodgers, M. Y. (2011). How access to credit affects self-employment: Differences by gender during India’s rural banking reform. The Journal of Development Studies, 47(1), 48–69.

Patel, C. P., Lenka, S., & Parida, V. (2022). Caste-based discrimination, microfinance credit scores, and microfinance loan approvals among females in India. Business and Society, 61(2), 327–388.

Rehman, A. (2023). Essays on loan disbursed to microfinance institutions by financial institutions: Insights from India. International Journal of Management and Business Research, 7(3), 43–49.

Srinivasan, N. (2008). Sustainability of SHGs in India. In K. G. Karamakar (Ed.), Microfinance in India (pp. 177–178). Sage Publications.