1 Institute of Management Studies and Research, Vivekanand Education Society, Mumbai, Maharashtra, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Accounting software is used by organisations to record their day-to-day financial transactions, which include fixed assets management, expense management, revenue management, accounts receivables, accounts payable, etc. The major problem faced by the users is misperception in using the software for their day-to-day accounting and business needs. The biggest problem for accounting software users is unsuitable accounting packages and apps which has inadequate and unauthorised data. Many firms and organisations do not take correct decisions based on fundamentals due to a lack of information and use of the right accounting software. The question arises of how to select the right accounting software for the business and what are the factors influencing the decision-making process for business performance. We collected data from accounting software users from different firms/organisations and found that accounting software is used majorly in the age group of 20–40 years. SAP, Tally and Algol are the prime software used for recording purposes. Reliability, data quality and ease of use are considered while selecting the software. As per the survey, accounting software helps in increasing profitability, improves productivity and helps in reducing costs.

Accounting software, profitability, cost control, financial transactions

Introduction

Accounting plays a very important role in day-to-day operations of a business by recording the daily monetary transactions of business activities. All business organisations try to monitor their financial information and records which can be used in various decision-making activities of the business. Accounting helps in tracking the incomes and expenses of the business, providing quantitative financial information to the stakeholders and even ensuring statutory compliance of the business.

Changes in information technology (IT) have made organisations keep pace with accurate and up-to-date accounting records. Accounting software helps organisations to keep all financial information updated with immediate access to real-time, accurate financial data. It provides visibility into operational performance and the company’s financial health. Accounting software helps to create reports quickly and easily. It also helps in increasing functionality, improved accuracy, faster processing and better external reporting of overall business performance.

Accounting software has evolved to meet the demands of a digital world, and the cloud has been key to this transformation. This has improved back-office accounting software to a comprehensive, mission-critical and integrated solution designed for innovation. As companies encounter many new disruptive forces and competitive pressures, these cloud-based accounting systems resolve the problems and enable them to achieve financial strength.

Literature Review

Patricia (2022) studied the effect of a computerised accounting system (CAS) on the organisational functioning of oil and gas firms in Nigeria Amahalu Nestor NDUBUISI (2017) assessed the CAS and manual accounting system of quoted microfinance banks in Nigeria. Wickramsainghe (2017) discussed the clarity in using accounting software by the intended users which is suitable based on their day-to-day accounting and business needs. Yvonne Chong (2018) tried to investigate and explore the impact of accounting software on the business performance of Malaysian firms. KUMAR (2019) examined to help the firm owners and managers understand the importance of using accounting information systems to achieve business performance. The result showed that accounting software has an impact on business performance. Cragg (2002) found that the alignment of an IT strategy with business strategy increased a firm’s performance. The synchronisation of organisational structure with IT structure improves business performance. Sam (2012) conducted a study on Melaka’s small- and medium-sized businesses' adoption of CAS. However, there has not been any published research examining how accounting software features affect how well business’ function.

Donggo (2021) examined and investigated the reasons for utilising AIS on a firm’s functioning. The researcher used several attributes such as efficiency, reliability, ease of use, data quality and accuracy to find out the impact and suggested that dimensions of utilising AIS are significant for improving the performance of business organisations. Daru (2016) talked about the role of accounting software in recent scenarios. He discussed the advantages and benefits of accounting software for business transactions which help in quick reporting and easy processing and storage of financial information. The paper displayed the most recent developments in small- to medium-sized firm accounting information systems. In an effort to better understand how IT affects accounting processes, Maziyar Ghasemi (2011) made this attempt. The capacity of businesses to create and employ computerised systems to monitor and record financial activities has the greatest influence, according to the report. The amount of time that accountants need to compile and deliver financial information to management has decreased because of IT networks and computer systems.

Much past research has shown that accounting information system adoption does increase a firm’s performance, profitability and operations efficiency in Malaysia, Finland, Spain, Iran and Pakistan. New computer tools and information society enabled companies in Turkey to effectively use their accounting system in dealing with customers and suppliers . Nzomo (2013) indicated that there exists a relationship between AIS, an effective decision-making tool and organisational performance.

Thottoli (2021) aimed to determine the influence of knowledge and use of accounting software among small and medium entrepreneurs (SMEs) in Oman by using a qualitative approach. The study used a purposive sampling method and revealed that the knowledge of accounting software has a significant effect on its use and knowledge. Generalised or customised accounting software can be used to make it more effective. Hawkar Anwar Hamad (2021) discussed the significant contribution of SMEs in the country’s economic development. The progress of technology has an impact on all businesses, highlighting variable costs, business size, infrastructure, management support, external environment and perceived ease of use being important considerations. Yagnesh Mohan Dalvadi (2017) focused on the importance of accounting in an organisation’s position and maintaining the same is very important. Nowadays, every company maintains accounts in digital format with the help of accounting software. The paper discussed several reasons and different motives behind using computerised accounting. Kayigamba (2015) focused on the impact of CAS on the financial reporting of the ministry of local government in Rwanda. The study evaluated the use of the accounting system by the ministry for generating qualitative and reliable financial reports. The study also talked about the benefits of accounting systems for the end users in getting quick financial transactions and other services. The study recommended constant and continuous training for the finance and accounting staff by the authorised dealers. Boateng (2021) evaluated the impact of the use of accounting software on the processing of financial information by taking convenient sampling. The study found that there is a positive relationship between the use of accounting software and the efficiency of processing financial information. The study says that accounting software is used for undertaking all accounting activities and is accepted by employees. It helps in the skills and expertise of employees, cost–benefit analysis and decision-making.

Research Gap

After doing a literature review on papers related to accounting software, we found that many studies are conducted on the use of accounting software by firms in different countries using parameters such as ease of use, cost-effectiveness, reliability, accuracy, etc. However, little research is carried out in India to assess the impacts of accounting software use on the performances of the firms. Therefore, this study is an attempt to fill this gap.

Objectives of the Study

Hypothesis

Scope of the Study

The main purpose of this study is to help firms in selecting the right, cheap and user-friendly accounting software to record their day-to-day transactions systematically. Good accounting software will provide accurate and timely reports with better results for the organisations, which will help them in making crucial business decisions about the firm and its future.

Research Design

The study has used both primary and secondary data sources. A questionnaire was prepared to collect the primary data containing details of accounting software used by firms in Mumbai. It was sent to approximately 130 respondents who are using accounting software. Out of 130 respondents, 87 answered the questionnaire and based on their responses the analysis is done.

The study also includes interviews with a few selected working professionals.

Secondary data for the study are collected from different websites, research journals, articles, books, etc.

Dependent variables: Business performance (profitability, accountability, productivity and cost control.

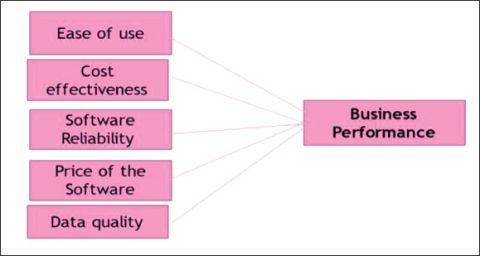

Independent variables: Ease of use, effectiveness, software reliability, price of the software and data quality (Figure 1).

Ease-of-use and business performance: The success of an accounting system depends on the level of ease-of-use and its benefits in the work. The user should understand the system easily and should have a positive influence on the output quality of the business.

Cost-effectiveness: Cost is an important factor when using accounting software. The speed and efficiency of accounting software go hand-in-hand with reducing the overall costs. The accounting system helps to reduce the number of work hours, which can also reduce the accounting department’s payroll and administration costs. Accounting software helps with tedious calculations and other quantitative tasks in much easier ways.

Software reliability: Accounting software helps in producing reliable data, which is very helpful in planning, identifying and controlling business operations. An essential characteristic of accounting data is reliability, which measures how accurate, error-free and faithfully represented the data are so that they can be utilised to make critical decisions.

Figure 1. Characteristics of Accounting Software.

Price of the software: The price of the software is based on the features of the software and a company selects software as per its day-to-day usage. Accounting software drives down costs and enhances the efficiency of a business. It increases the productivity of the company’s personnel and benefits the company by becoming more cost-effective.

Data quality and business performance: Data are very important and critical for any business. The performance of any business depends on the output, which itself is the result of data quality. A firm needs data, processes of data production take place through data collection, and proper data utilisation and storage of data is required for satisfactory performance of the organisation. Incomplete and erroneous data would hurt a business’s ability to compete since they might have a negative impact on decision-making and, as a result, the performance of the firm.

Data quality in the research is used for measuring accuracy, completeness, validity, consistency, uniqueness, timeliness and fitness for purpose. It ensures the company makes data-driven decisions and meets their business goals. Duplicate data, missing values and outliers, if not addressed properly, may increase the risk for the business and have negative outcomes.

Research Methodology and Technique

To check the reliability, Cronbach’s alpha test model is used in the study. It shows that all questions are highly reliable to analyse. It also indicates the better internal consistency of each question which is used to measure the variable. All the means and standard deviations show that the data set is normally distributed with no outliers or missing values. This research used multiple regression analysis using SPSS.

Limitations

Data Analysis

Demographic Analysis

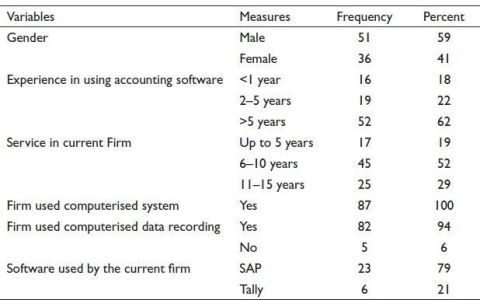

The distribution of the respondents' demographics is shown in Table 1. 41% of respondents were men, whereas 59% of respondents were women. The information gathered indicates that more women are employed and utilised accounting software. Data indicated that young people between the ages of 20 and 30 utilised an accounting computer system. Fifty-two respondents in total had more than 5 years of experience with accounting software. The demographic profile also revealed that all businesses adopted CAS, with more than 90% using these systems to record data. With 23 businesses utilising it, SAP was the most widely used accounting software in India, followed by Tally in six firms.

Table 1. Demographic Study.

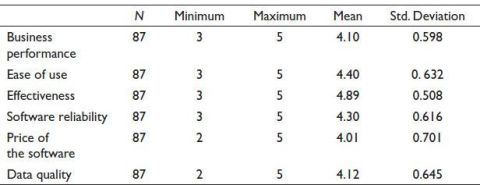

Table 2. Descriptive Statistics.

Descriptive Analysis and Normality Analysis

One dependent variable and five independent factors make up this study. Business performance is a dependent variable, and it is assessed using data quality, software pricing, software dependability and simplicity of use (Table 2).

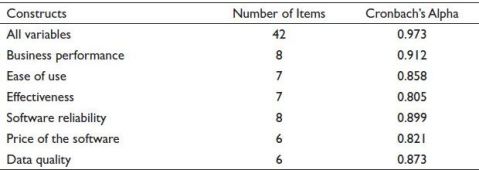

Table 3. Cronbach’s Alpha Coefficients.

According to the descriptive study, dependability, efficacy and simplicity of use all contributed to improved company performance, with respective means of 4.40, 4.89 and 4.30 and standard deviations of 0.632, 0.508 and 0.616. Software cost and data quality, which have respective mean values of 4.01 and 4.12 and standard deviations of 0.701 and 0.645, are two more significant independent factors having little impact on business performance. Since all of the means are positive, the data set is excellent.

Reliability Analysis

Reliability is a test that helps to ensure the overall consistency of measures. It is tested by Cronbach’s alpha. The generally accepted rule describing internal consistency is as follows: excellent > 0.9; good > 0.8, acceptable > 0.7; questionable > 0.6; poor > 0.5; unacceptable < 0.5. Table 3 shows all the constructs in this research are reliable. All the variables (dependent and independent) chosen for the study have Cronbach’s alpha scoring of above 0.80, indicating all variables are acceptable with high internal consistency.

Regression Analysis

To determine the influence of accounting software on business performance based on five independent variables—ease of use, efficacy, software dependability, price of the program and data quality—this research used multiple regression analysis in SPSS. In this study, company performance is the dependent variable. The entire research model’s significance in achieving the desired outcome is demonstrated by the regression model.

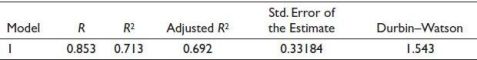

The model summary (Table 4) shows the R as 0.853, R2 shows the impact of accounting software on the business performance of firms in India as 0.713 and adjusted R2 is 0.692, which shows that the measure of variability of accounting software can be predicted by the independent variables of ease of use, effectiveness, data quality, software reliability and price of the software. In normal cases, the healthy relationship between dependent variables and independent variables should be more than 60%. As we have found the relationship is more than 60%, this model is found to be a good fit. Finally, the Durbin–Watson is found to be 1.543, which clearly indicates no autocorrelation amongst the chosen sample. This value should be between 1.5 and 2.5, which indicates that each sample is separately independent and is not influenced by the other samples.

Table 4. Regression Model Summary.

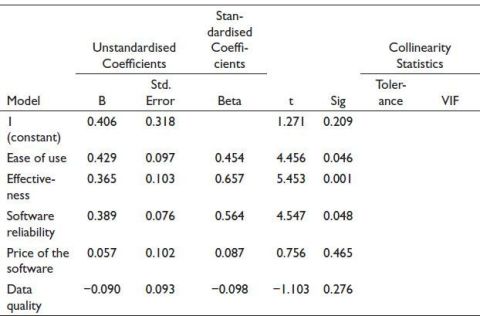

Table 5. Coefficient.

Hypothesis Testing

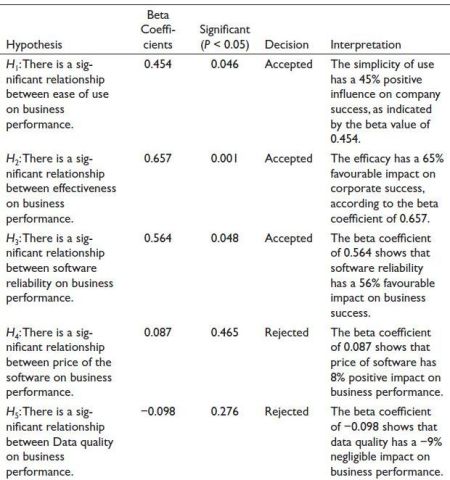

Table 5 shows that the hypothesis testing for the independent variables based on the significant value from regression analysis conducted using the SPSS tool. The standardised beta coefficients show the influence of independent variables on the dependent variable (Table 6).

The table demonstrates that software dependability, effectiveness and usability have moderate and substantial impacts on company performance, with respective p values [Sig.] less than 0.05 of 45%, 65% and 56%. Therefore, if software stability, usability and convenience of use improve, so will company performance. However, as the p values [Sig.] are more than 0.05, data quality has a minor influence of −9%. The price of the software’s standardised coefficient of beta, which is 8%, indicates that it has a favourable effect on business performance.

Table 6. Conclusion of Hypothesis Testing Results.

The R2value is 71%, while adjusted R2value is 69%, according to multiple regression analysis. Given that the model’s p value is 0.04—less than 0.05—when the confidence interval’s 95% is taken into account, we may infer that the model is statistically significant.

The effects of each independent variable on the dependent variable (business performance) are depicted by the beta coefficients.

With p values less than 0.05, it can be seen that software reliability, cost-effectiveness and ease of use each have a moderate impact on business performance. It also demonstrates a favourable association between corporate success and ease of use, software dependability and cost-effectiveness. As a result, improving these elements will boost business performance.

Data quality and the cost of the programme, however, only slightly affect the impact on business performance as p value is greater than 0.05.

Apart from the above analysis, a few accounting professionals in their interviews also talked about the benefits of using accounting software like getting financial results at a single click, accuracy of data, saving of time, reduction in costs, etc. Accounting software also helps with procurement of material and material management and covers all the accounting processes, which makes it easy for the users.

Challenges Faced by Users of Accounting Software:

Conclusion

This study was done to find out how accounting software affects Indian companies' commercial performance. To determine the effects of independent factors (ease of use, efficacy, software reliability, price of the program and data quality) on the dependent variable (business performance), regression analysis was used. All of the variables—dependent and independent—selected for the study have Cronbach’s alpha scores over 0.80, suggesting that they all have a good level of internal consistency. Out of the five independent variables, the regression analysis revealed that three (ease of use, software reliability and cost-effectiveness) have a substantial impact on company success. In contrast, it was discovered that none of the other two variables—data quality nor software price—had a major effect on company success. In conclusion, accounting software systems are very significant and valuable to organisations, enterprises and the economy. Users of accounting software benefit from lower costs, reliable data, time savings and speedy financial reports for decision-making.

Research Contribution

Selection and use of accounting software help the organisation to generate financial reports and save time. With the help of accounting software, companies can get accurate and fast data in a synchronised manner. The study shows that the most preferred accounting software is SAP and Tally because of its ease of use, reliability, accuracy and cost-effectiveness.

Future Scope

In the future, studies can be done by analysing other accounting software covering more sample sizes from different industries. A detailed analysis should be done on which software is preferred by the companies and why. Research can be done on a specific sector and challenges faced by the users of accounting software.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Pallavi Sachin Vartak  https://orcid.org/0000-0003-4000-2265

https://orcid.org/0000-0003-4000-2265

Amahalu Nestor Ndubuisi, A.M.-F. (2017). Comparative analysis of computerized accounting system and manual accounting system of quoted microfinance banks (MFBs) in Nigeria. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(2), 30–43.

Boateng, C. (2021). Evaluating the impact of the use of accounting software on the processing of financial information. A case of Ghana Education Service, New Juaben Municipality.

Cragg, P. B., King, M., & Hussin, H. (2002). IT alignment and firm performance in small manufacturing firms. Journal of Strategic Information System, 11(2), 109–132.

Daru, M.U. (2016). Role of accounting software in today scenario. International Journal of Research in Finance and Marketing, 6(6), 25–34.

Donggo, V.P. (2021). The effects of employing accounting software on business performance. Scribd.

Esmeray, A. (2016). The impact of accounting information systems (AIS) on firm performance: Empirical evidence in Turkish small and medium enterprises. International Review of Management and Marketing, 6(2), 233–236.

Hawkar Anwar Hamad, P.A. (2021). The influence of accounting software in minimizing business costs. International Journal of Engineering, Business and Management (IJEBM), 5(5), 1–10.

Kayigamba, S.M. (2015). The impact of computerized accounting system on financial reporting in the ministry of local government of Rwanda. Journal of Emerging Trends in Economics and Management Sciences, 6(4), 1–10.

Kumar, J. (2019). The impact of accounting software on business performance of firms in Coimbatore district, Tamilnadu. JETIR, 6(5), 1–8.

Maziyar Ghasemi, V.S. (2011). The impact of information technology (IT) on modern accounting systems. Procedia: Social and Behavioral Sciences, 28, 112–116.

Nzomo, S. (2013). Impact of accounting information systems on organizational effectiveness of automobile companies in Kenya.

Patricia, C.D. (2022). Effect of computerized accounting system on organisational. British Journal of Management and Marketing Studies, 5(3), 66–88.

Sam, M.F. (2012). The adoption of computerised accounting system in small and medium enterprises in Melaka, Malaysia.

Thottoli, M.M. (2021). Knowledge and use of accounting software: Evidence from Oman. Journal of Industry-University Collaboration, 3(1), 2–14.

Wickramsainghe, D.P. (2017). Impact of accounting software for business. Imperial Journal of Interdisciplinary Research, 3(5), ISSN: 2454–1362.

Yagnesh Mohan Dalvadi, H.R. (2017). A study on factors governing adoption of computerized accounting system in SMEs' of Gujarat. International Journal of Research in Management & Social Science, 5(3), 1–12.

Yvonne Chong, I.N. (2018). The impact of accounting software on business performance. International Journal of Information System and Engineering, 6(1), 1–26.