1Department of Economics, Dennis Osadebay University, Asaba, Delta State, Nigeria

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The research examined the impact of digital financial sustainability and institutional quality on economic growth. The research is founded on 26 chosen Sub-Saharan African (SSA) nations, and the data available span 1993–2023. The generalised linear model estimation technique was used. The results show that private sector credit and access to credit to the private sector positively and significantly affect growth in SSA nations. Broad money supply has a positive yet not significant impact on economic growth. Automated teller machine (ATM) penetration level increase and an increase in the account holder population have a positive impact on economic growth, while high dissemination of bank deposit and lending rate has a negative impact on economic growth. It has been found by this study that digital financial sustainability has not played a significant role in economic growth in SSA nations. However, the results of the interactive effect of digital financial sustainability on both political stability and government effectiveness have a positive effect on economic growth in SSA countries. The article suggests institutional quality improvement in the dimension of government effectiveness and political stability and improved access to credit facilities for the achievement of sustainable economic growth in SSA countries.

Digital financial sustainability, economic growth, institutional quality, Sub-Saharan African countries

Abu, N. I. (2024). Financial inclusion and economic development, African Banking and Finance Review Journal, 13(13), 43–62.

Aghion, P., Akcigit, U., & Howitt, P. (2015). Lessons from Schumpeterian growth theory. American Economic Review, 105(5), 94–99.

Ahmed, K., Khan, B., & Ozturk, I. (2021). Dynamics between disaggregates of governance and stock market performance in selected South Asia countries. International Journal of Finance and Economics, 26(1), 802–813.

Allen, F., Demirguc-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation, 27(1), 1–30.

Amoo, G. B. A., Eboreime, M. I., Adamu, Y., & Belonwu, M. C. (2017). The impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 8(2), 1–22.

Arcand, J I., Berkes, E., & Panizza, U. (2015). Too much finance? Journal of Economic Growth, 20(2), 105–148. https://doi.org/10.1007/s10887-015-9115-2

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Banna, H., Hassan, M. K., & Alam, M. R. (2020). Digital financial inclusion, Islamic banking stability and sustainable economic growth. In Islamic perspective for sustainable financial system (pp. 131–152).

Beck, T., Levine, R., & Loayza, N. (2000). Finance and the sources of growth. Journal of Financial Economics, 58(1), 261–300.

Bencivenga, V., & Smith, B. (1991). Financial intermediation and endogenous growth. Review of Economic Studies, 58(2), 195–209.

Bofinger, P., Geißendörfer, L., Haas, T., & Mayer, F. (2021). Discovering the true Schumpeter-new insights into the finance and growth nexus (CEPR Discussion Paper No. 16851).

Bu, Y., Yu, X., & Li, H. (2023). The nonlinear impact of Fintech on the real economic growth: Evidence from China. Economics of Innovation and New Technology, 32(8), 1138–1155.

Bustinza, H. D. A., de Souza, B., De la Cruz Rojas, R. Bustinza H. D., A. (2024). Inclusive economic growth. In International trade and inclusive economic growth (pp. 19–64). Emerald Publishing Limited.

Cecchetti, G., & Kharroubi, E. (2012). Reassessing the impact of finance on growth. Bank for International Settlements (BIS) Working Papers No. 381, Bank for International Settlements, Basel, Switzerland.

Cevik, S. (2024). Is Schumpeter right? Fintech and economic growth (International Monetary Fund Working Paper, WP/24/20).

Chen, X., Teng, L., & Chen, W. (2022). How does fintech affect the development of the digital economy? Evidence from China. North American Journal of Economics and Finance, 61(C), 101697.

Chinoda, T., & Kapingura, F. M. (2024). Digital financial inclusion and economic growth in Sub-Saharan Africa: The role of institutions and governance. African Journal of Economic and Management Studies, 15(1), 15–30.

Emara, N., & Chiu, I.-M. (2015). The impact of governance on economic growth: The case of Middle Eastern and North African countries. Economic Systems, 39(2), 186–202. https://doi.org/10.1016/j.ecosys.2014.05.002

Fisman, R., & Love, I. (2007). Financial dependence and economic growth revisited. Journal of European Economic Association, 5(2–3), 470–479.

Kanga, D., Oughton, C., Harris, L., & Murinde, V. (2021). The diffusion of fintech, financial inclusion and income per capita. European Journal of Finance, 28(1), 108–136.

Khera, P., Ng, M. S. Y., Ogawa, M. S., & Sahay, M. R. (2021). Is digital financial inclusion unlocking growth? International Monetary Fund.

King, G. R., & Levine, R. (1993a). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737.

King, G. R., & Levine, R. (1993b), Finance, entrepreneurship and growth. Journal of Monetary Economics, 32(3), 513–530.

Kooli, C., Shanikat, M., & Kanakriyah, R. (2022). Towards a new model of productive Islamic financial mechanisms. International Journal of Business Performance Management, 23(1–2), 17–33.

Laeven, L., Levine, R., & Michalopoulos, S. (2015). Financial innovation and endogenous growth. Journal of Financial Intermediation, 24(1), 1–24. https://doi.org/10.1016/j.jfi.2014.04.001

Law, S., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking and Finance, 41(C), 36–44.

Liu, S., & Zhang, H. (2024). Governance quality and green growth: New empirical evidence from BRICS. Finance Research Letters, 65, 105566. https://doi.org/10.1016/j.frl.2024.105566

Li, C., & Wong, J. C. (2018). Financial development and inclusion in the Caribbean. International Monetary Fund (IMF) Working Paper WP/18/53, International Monetary Fund, Washington.

Maruta, A. A., Banerjee, R., & Cavoli, T. (2020). Foreign aid, institutional quality and economic growth: Evidence from the developing world. Economic Modelling, 89, 444–463.

Ngeze, R. M., & Sei, M. (2024). The impact of financial technology (Fintech) on economic growth: Evidence from Tanzania. African Journal of Economics and Business Research, 3(2), 1–27.

Ngong, C. A., Thaddeus, K. J., & Onwumere, J. U. J. (2024). Financial technology and economic growth nexus in the East African community states. Journal of Economics, Finance and Administrative Studies, 29(58), 263–276. https://doi.org/10.1108/JEFAS-01-2022-0009

Nkoa, B. E. O., & Song, J. S. (2020). Does institutional quality affect financial inclusion in Africa? A panel data analysis, Economic Systems, 44(4), 100836.

Olowofeso, E. O., Adeleke A., O., & Udoji, A. O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81–101.

Ozturk, I., & Ullah, S. (2022). Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis, Resources, Conservation and Recycling, 85(1), 106489.

Pal, S., Vankila, S., & Fernandes, M. N. (2025). Interplay of financial inclusion and economic growth in emerging economies. World Development Sustainability, 6(100201), 1–14, https://doi.org/10.1016/j.wds.2025.100201

Rousseau, P., & Wachtel, P. (2011). What is happening to the impact of financial deepening on economic growth? Economic Inquiry, 49(1), 276–288.

Schumpeter, J. A. (1912). The theory of economic development. Routledge.

Siyakiya, P., Erdoğdu, M. M., & Akay, E. Ç. (2023). Impact of industrialization on economic development in selected African and Asian economies: The role of institutional quality and investment climate. SN Business & Economics, 3(12), 211.

Song, N., & Appiah-Otoo, I. (2022). The impact of fintech on economic growth: Evidence from China. Sustainability, 14(10), 1–7.

Sreenu, N., & Verma, S. S. (2024). Enhancing economic growth through digital financial inclusion: An examination of India. Transnational Corporations Review, 16(4), 200091. https://doi.org/10.1016/j.tncr.2024.200091

Swamy, V., & Dharani, M. (2019). The dynamics of finance-growth nexus in advanced economies. International Review of Economics and Finance, 64(C), 122–146.

Thaddeus, K., Ngong, C., & Manasseh, C. (2020), Digital financial inclusion and economic growth: Evidence from Sub-Saharan Africa (2011-2017). International Journal of Business and Management, 8(4), 212–217.

World Bank. (2018). UFA2020 overview: Universal financial access by 2020. https://www.worldbank.org/en/topic/financialinclusion/brief/achieving-universal-financial-access-by-2020

Wu-Po, L., & Ya-Ching, C. (2024). FinTech, economic growth, and COVID-19: International evidence. Asia Pacific Management Review, 29(3), 362–367. https://doi.org/10.1016/j.apmrv.2023.12.006

Wysokińska, Z. (2021). A review of the impact of the digital transformation on the global and European economy. Comparative Economic Research. Central and Eastern Europe, 24(3), 75–92.

Yiadom, E. B., Dziwornu, R. K., & Yalley, S. (2021). Financial inclusion, poverty and growth in Africa: Can institutions help? African Journal of Economic and Sustainable Development, 8(9), 91–110.

Zhang, G. J., Chen, Y., Wang, G. N., Zhou, C. S. (2023). Spatial-temporal evolution and influencing factors of digital financial inclusion: county-level evidence from China. Chinese Geographical Science, 33(2), 221–232. https://doi.org/10.1007/s11769-023-1333-5”10.1007/s11769-023-1333-5

Zhu, X., Asimakopoulos, S., & Kim, J. (2020). Financial development and innovation-led growth: Is too much finance better? Journal of International Money and Finance, 100(C), 1020.

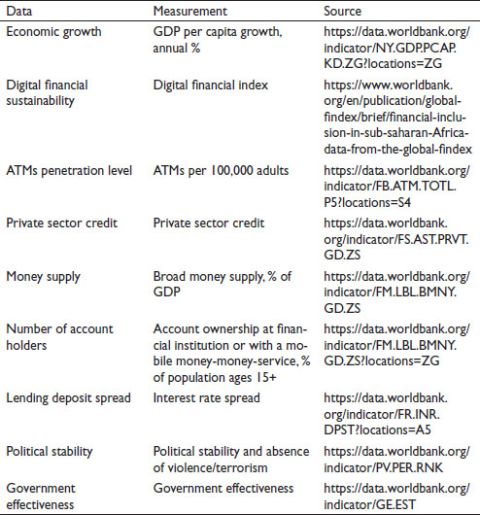

Appendix: Data Sources.

List of countries included in the study:

Angola, Cameroon, Comoros, Botswana, Uganda, Cape Verde, Egypt, Zimbabwe, Congo Rep, Guinea, Guinea-Bissau, Ghana, Lesotho, Madagascar, Mali, Malawi, Morocco, Kenya, Nigeria, Rwanda, Namibia, Eswatini, Seychelles, Uganda, South Africa and Zambia.